Uranium and the Quest for A Sustainable Energy Future

Hong Kong, Oct 11, 2024

Uranium is a silvery-white metallic chemical element in the periodic table, with atomic number 92. Uranium "enriched" into U-235 concentrations is the primary fuel for nuclear power plants and the nuclear reactors that run naval ships and submarines, making it a critical element for nuclear energy.

As the world grapples with climate change and the transition to cleaner energy sources, nuclear power is increasingly seen as a key solution. As the primary fuel for nuclear reactors, uranium’s market dynamics are crucial to the future of the energy industry. Uranium was historically primarily extracted through open-pit and underground mines, however, with advances in technology, alternative methods of producing uranium such as in-situ leach mining have become more prominent.

This report delves into the current state of the uranium market, its supply and demand, major and emerging players, and price trends.

Global Uranium Supply

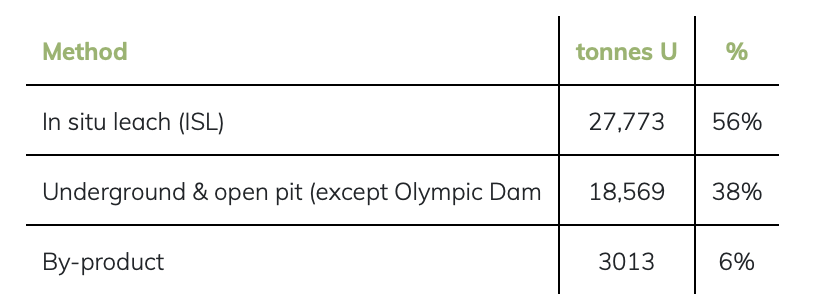

Mining remains the main source of uranium, accounting for approximately 90% of the total uranium consumption globally with in-situ leaching (ISR) dominating due to its efficiency and lower environmental impact. Remaining methods like recycling from the spent fuel, and by-product recovery play smaller roles and account for around 10%.

Uranium Mining

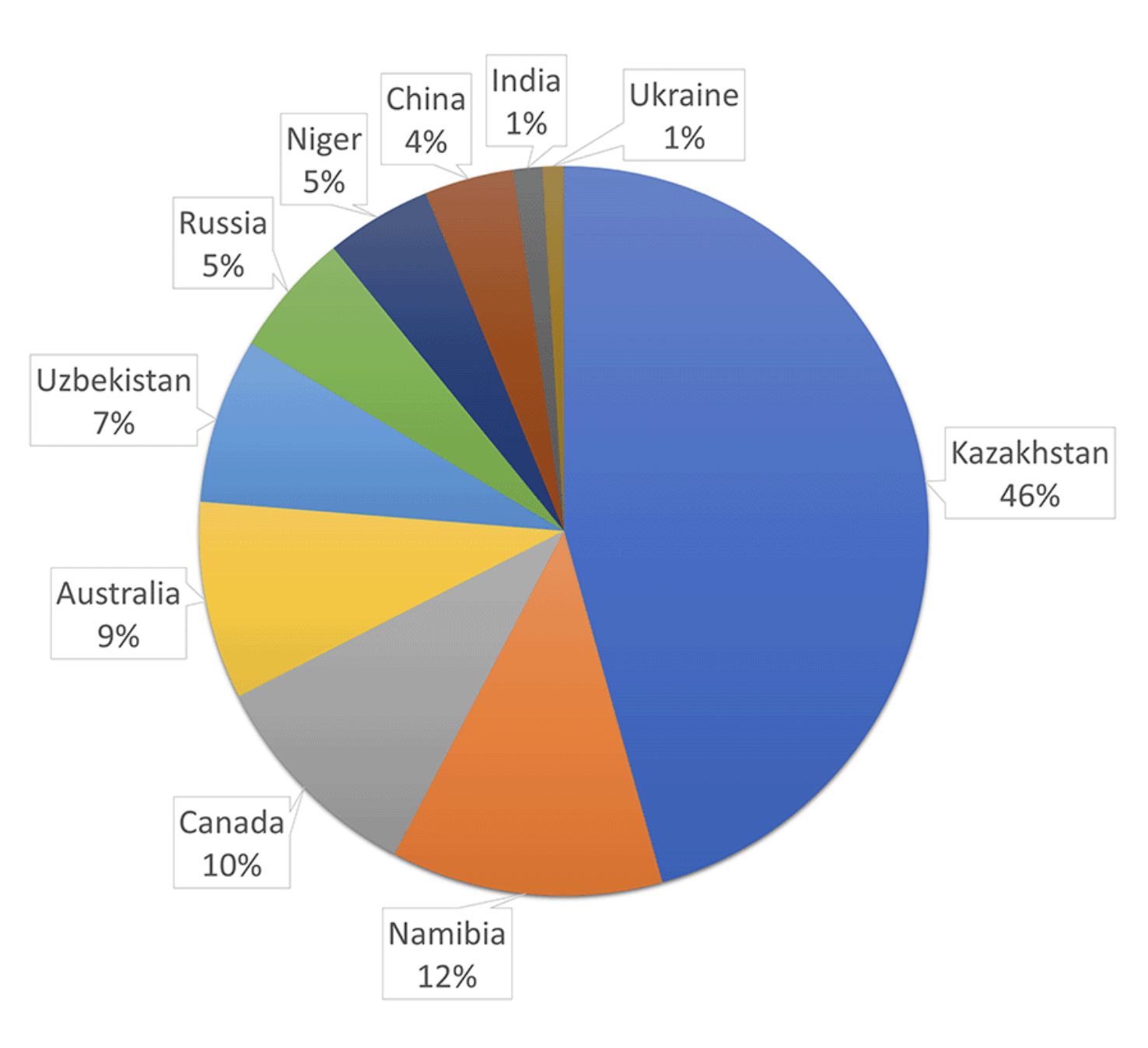

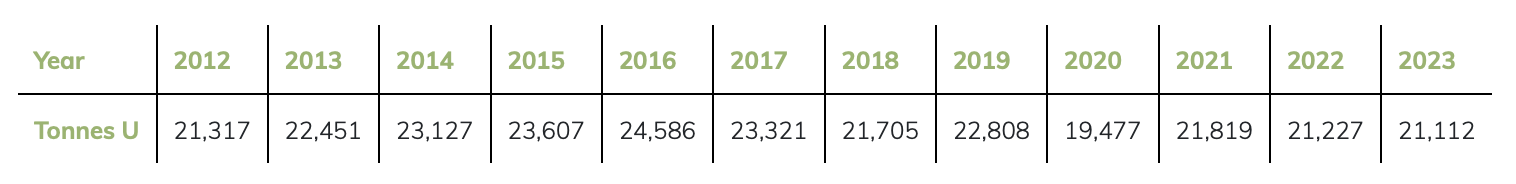

The global uranium production landscape is dominated by a few key countries. As of 2023, Kazakhstan remains the largest producer, accounting for approximately 46% of the world’s uranium production. Other major producers include Namibia (12%), Canada (10%), Australia (19%), and Uzbekistan (7%).

In 2021, Kazakhstan, Canada, and Australia alone produced 77% of the world’s production from their mines.

In the late 20th century, in situ leach (ISL, also called in situ recovery, ISR) emerged as a less invasive method. This technique involves injecting a solution into underground uranium deposits to dissolve the uranium, which is then pumped to the surface.

ISR minimizes surface disturbance and reduces waste, making it a more environmentally friendly option compared to traditional methods. In 2022 ISL accounted for 56% of production.

Uranium Market Players

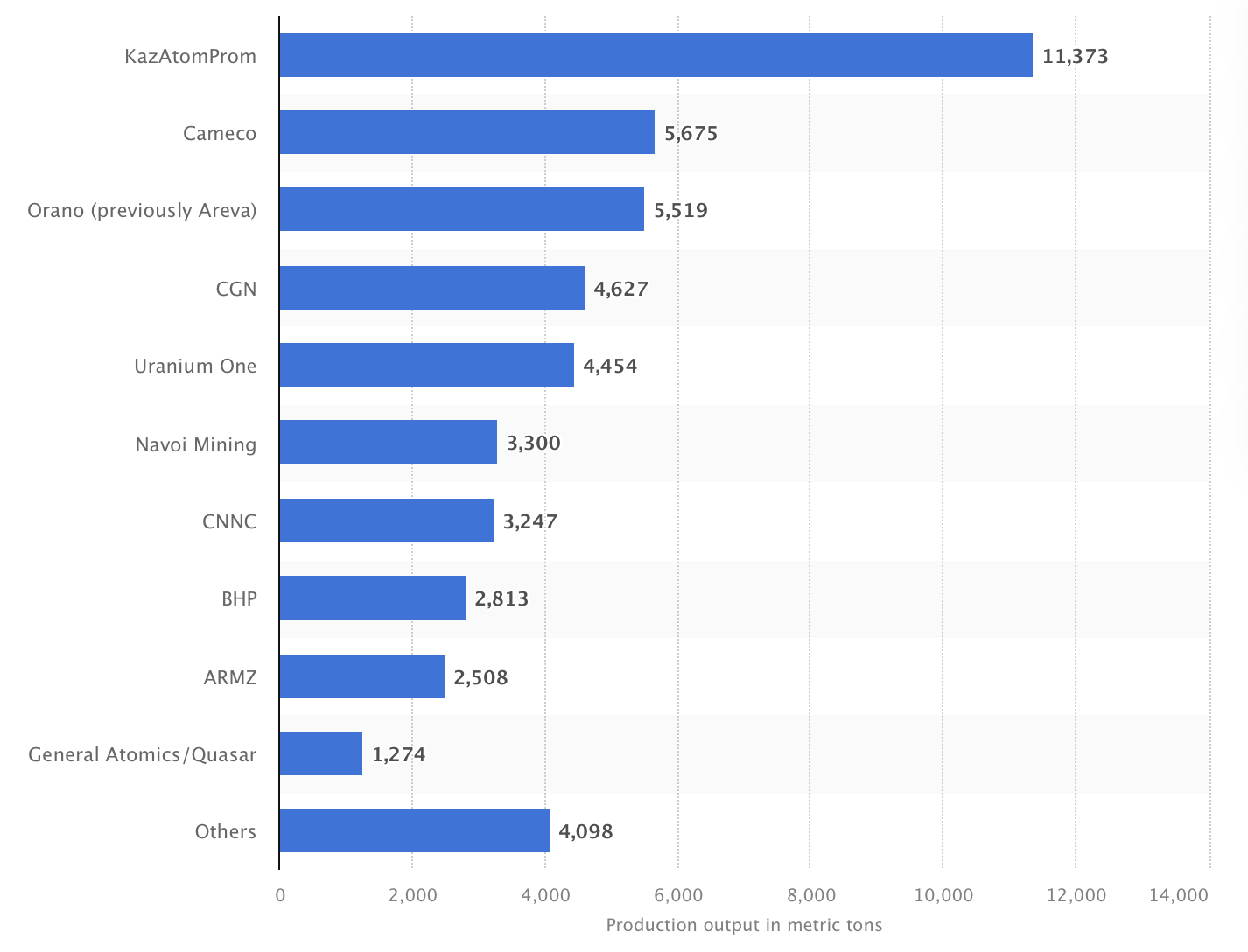

The uranium market is quite concentrated, with several companies controlling the majority of the market share. In 2022, the top 10 companies by production contributed over 90% of the world's uranium production.

Major Players

The dominant players include Kazatomprom (Kazakhstan), Cameco (Canada), and Orano (ex Areva, France), which hold approximately 50% of the market share.

Kazatomprom (KASE: KZAP, market cap: USD 9.70 B as of 09 Oct 2024) is well-positioned to remain the dominant player with the world's largest uranium production (21.2 thousand tonnes in 2022) and mineral resource (1,323 Mlbs Triuranium octoxide (U3O8), a compound of uranium). KZAP operates through its subsidiaries, JVs and Associates, 26 deposits grouped into 14 asset clusters, all of which are located in Kazakhstan.

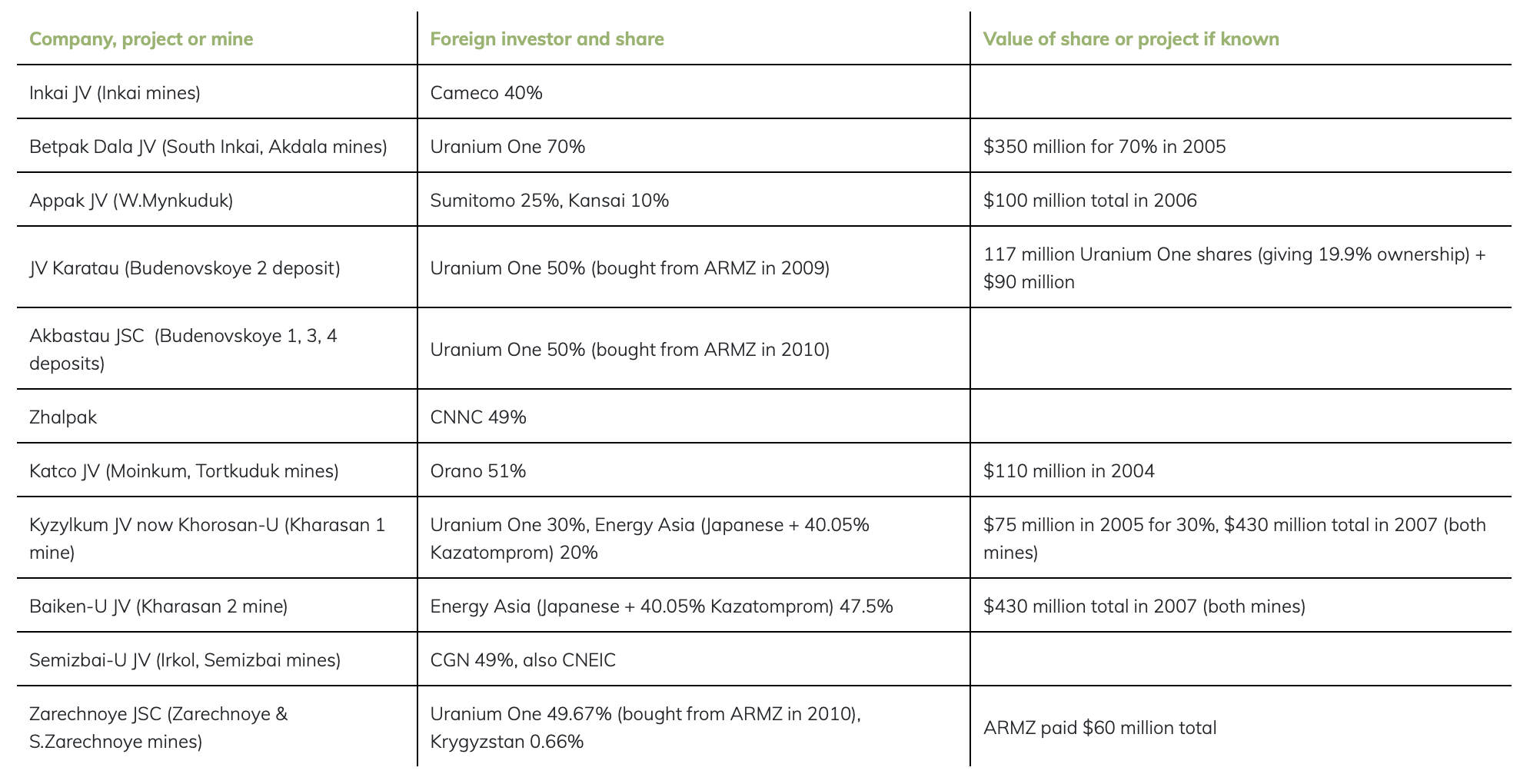

Kazakhstan’s uranium industry is characterized by a high degree of multinational collaboration. While KZAP controls most of the uranium production, numerous joint ventures exist with leading international energy and mining companies from Canada, France, Russia, and China. This multinational ownership structure ensures that Kazakhstan is deeply integrated into the global uranium supply chain.

Cameco Corp (NYSE: CCJ, market cap: USD 22.01 B as of 09 Oct 2024) is the world's largest publicly traded uranium company, based in Saskatoon, Saskatchewan, Canada with operations in the USA, Canada, Kazakhstan (40% share in Joint Venture with KZAP). The company is engaged in uranium mining, refining, conversion, fuel manufacturing, and nuclear fuel cycle activities. Its acquisition in Nov 2023 of Westinghouse makes it a miner with the second largest mineral resource (1,047 Mlbs Triuranium octoxide resource) and further expands its nuclear fuel cycle business.

Uranium One (private company) is an international group of companies, part of the management circuit of the TENEX Group of Rosatom State Corporation. Since 2013, it has been a wholly owned subsidiary of Moscow-based Uranium One Group, a part of the Russian state-owned nuclear corporation Rosatom. Though not the largest producer, it plays a strategic role in supplying fuel to Russian reactors and international buyers including the USA, China, and Europe.

Emerging Smaller Players: Fission Uranium Corp. (FCU.TO) and Paladin Energy Limited (ASX: PDN)

In addition to the key market players, smaller companies and junior miners are emerging to capitalize on the next wave of uranium demand driven by new reactor constructions. Upon the completion of PDN's acquisition of FCU, the combined entity will hold the 3rd largest resource among publicly listed uranium companies globally, following Kazatomprom and Cameco. This positions the merged company as a significant and impactful player in the uranium industry.

Supply Constraints

The uranium market is characterized by periodic supply disruptions, largely due to price volatility and regulatory concerns. In the past decade, major mines like Canada’s McArthur River (operated by Cameco) were temporarily closed due to low prices, further tightening the supply.

World's Largest Uranium Producer Reducing Output

Kazatomprom, the world’s largest uranium producer, has slashed its production target for 2025 due to project delays and sulphuric acid shortages, threatening to squeeze supplies of the radioactive fuel vital for nuclear power. The Kazakh company, which generates a fifth of the global uranium supply, cut its target for next year by 17% to a range of 25,000 to 26,500 tonnes of yellowcake. The move is likely to put upward pressure on uranium prices, which have softened from a 16-year high above USD 100 per pound this year but remain at historically elevated levels above USD 80 per pound, according to UxC.

Source: Financial Times

Russia's Move: Retaliation Amid Sanctions

Vladimir Putin has suggested that Russian officials consider imposing restrictions on exporting commodities like uranium. This move comes as a counter-response to the fresh sanctions from Western countries against Russia and its allies. Western nuclear reactors could face significant disruption and the European energy industry and energy securities will be affected also if Russia restricts uranium exports. Many reactors have long-term agreements with Russian suppliers, as Russia accounts for roughly one-third of the world's uranium enrichment capacity and about 5% of global uranium mining.

Global Demand

Primary Demand: Nuclear Power Generation

The primary demand for uranium comes from nuclear power plants for electricity generation. According to the World Nuclear Association, around 90% of all uranium consumption is dedicated to civilian nuclear power plants. There are currently around 440 operational reactors in 32 countries, with a combined capacity of about 390 GWe. In 2023 these provided 2602 TWh, about 9% of the world's electricity, and these reactors consume roughly 62,500 tons of uranium annually.

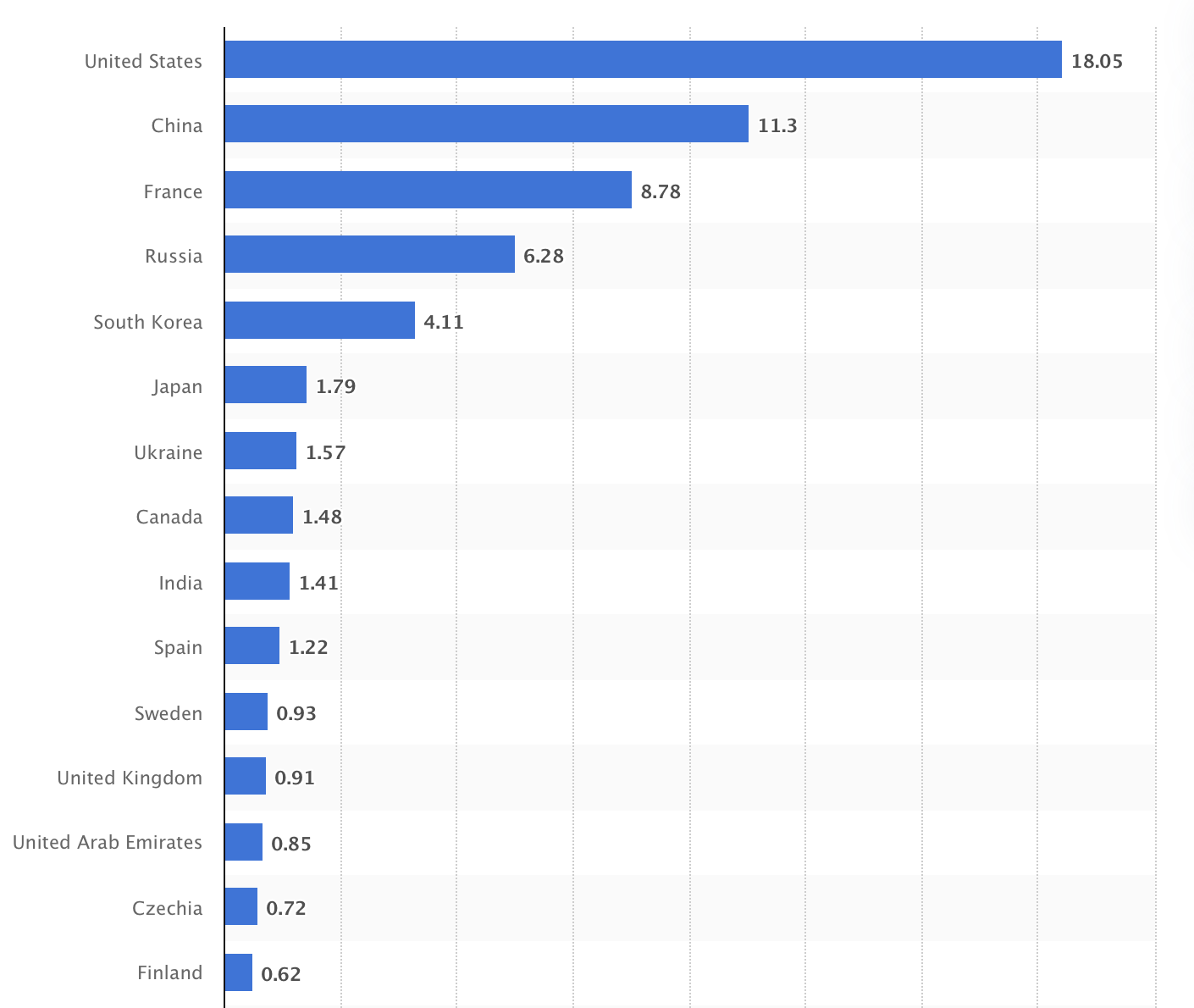

Consumption of Uranium by Countries

In 2022, the United States was the largest uranium-consuming nation worldwide, using a total of 18,050 metric tons of uranium, accounting for one-third of the global consumption, followed by China, France and Russia.

Growing Demand

The world is seeing two big trends - rising power demand and the need for clean energy, which are strong drivers for growing uranium demand.

Rising Power Demand for Electricity

As the world population grows and more people move to urban areas, the demand for electricity increases to power homes, businesses, industries, and infrastructure. Urban areas often have more energy-intensive lifestyles, driving up consumption.

The rise of digital technologies (e.g., data centres, cloud computing, AI) and electrification of transportation (e.g., electric vehicles) significantly increase power demand. Even sectors like manufacturing and logistics are becoming more automated and reliant on energy-intensive processes.

Nuclear Power as Clean Energy

Nuclear power is seen as a stable and sustainable source of baseload energy to help meet the rising demand for electrification. The WEO (World Energy Outlook) 2021 projects electricity generation growth of between 75% and 116% from 2020 to 2050 across its three main scenarios. In the Sustainable Development Scenario, nuclear generation increases by 2,022 TWh (75%) over the same period, necessitating a capacity increase of approximately 254 GW, or 61%. This growth will drive a significant rise in the number of reactors worldwide.

Source: World Nuclear Association

Global Increasing Reactors

Many countries with existing nuclear power programmes either have plans to or are building new power reactors. About 60 power reactors are currently being constructed in 16 countries, and a further 110 are planned, most of which are in Asia.

Countries like the United States, France, China, and Russia account for the bulk of nuclear energy production. China and India, in particular, are leading the charge in building new reactors, with China planning to build 150 new reactors by 2035. This could lead to a significant uptick in uranium demand.

Source: World Nuclear Association

Because of the cost structure of nuclear power generation, with high capital and low fuel costs, the demand for uranium fuel is much more predictable than with probably any other mineral commodity. Once reactors are built, it is very cost-effective to keep them running at high capacity and for utilities to make any adjustments to load trends by cutting back on fossil fuel use. Demand forecasts for uranium thus depend largely on installed and operable capacity, regardless of economic fluctuations. However, this picture may be complicated by policies which give preferential grid access to subsidized wind and solar PV sources.

Other Emerging Markets

As the global transition to cleaner energy sources, emerging economies such as India and several Middle Eastern nations are increasingly turning to nuclear power as part of their long-term energy strategies. For example, the United Arab Emirates’ Barakah nuclear plant, which became operational in 2020, represents the first step in a broader push for nuclear energy in the region. These developments indicate growing demand from previously underrepresented markets.

Technological Developments

The advent of Small Modular Reactors (SMRs) is a potentially game-changing technology for the uranium market. SMRs, being smaller and more flexible than traditional nuclear plants, require less uranium per reactor while operating with greater efficiency, which may negatively impact the uranium demand. However, they offer the advantage of being deployable in larger numbers, potentially offsetting the negative impact. Countries like the U.S., Canada, and the UK are actively investing in SMR development. While this innovation is not expected to affect near-term uranium prices, its impact on demand is anticipated by the end of this decade, around 2030.

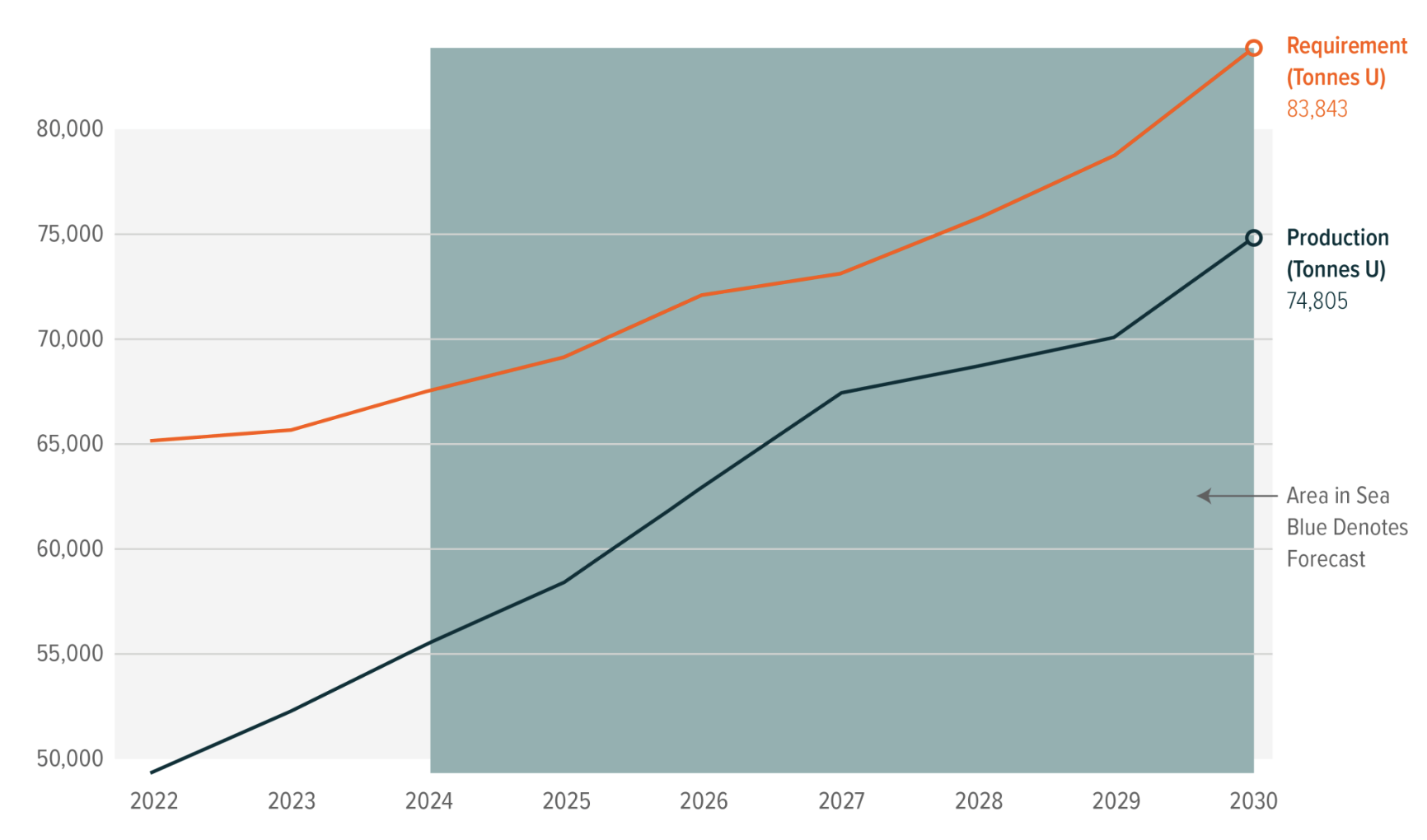

The Reference Scenario of the 2023 edition of the World Nuclear Association's Nuclear Fuel Report shows a 28% increase in uranium demand over 2023-30 (for an 18% increase in reactor capacity – many new cores will be required). Demand thereafter will depend on new plants being built and the rate at which older plants are retired – the Reference Scenario of the 2023 Nuclear Fuel Report has a 51% increase in uranium demand for the decade 2031-2040. Licensing of plant lifetime extensions and the economic attractiveness of continued operation of older reactors are critical factors in the medium-term uranium market. However, with electricity demand by 2040 potentially increasing by about 50% from that of 2022 (based on the International Energy Agency's World Energy Outlook 2023 report), there is plenty of scope for growth in nuclear capacity in a world aiming to reduce carbon emissions.

Source: World Nuclear Association

Uranium Pricing Trends

Uranium Historical Price: High Volatility

Uranium prices have historically been volatile. The price of uranium saw a major peak in 2007, reaching over USD 140 per pound, before crashing after the Fukushima disaster in 2011, which led to a significant reduction in nuclear energy projects. By 2020, uranium prices had fallen to around USD 25 to USD 30 per pound, reflecting subdued demand. At this level, the price was significantly below the cost of production for many mining operations, forcing them to shut down during that period.

In 2022, uranium prices began to recover, largely due to a combination of supply constraints and increasing interest in nuclear energy as part of global decarbonization efforts, rising from USD 50 to USD 60 per pound to over USD 100 in Jan 2024 and falling back to around USD 80 in Sep 2024.

.png)

Additionally, with the focus shifting towards mergers and acquisitions among mining companies rather than exploration activities in recent years, the lack of new sources being discovered is unlikely to alleviate the tightness in the uranium market.

According to UxC, the supply deficit of the uranium market will persist for the next decade with production consistently lower than the requirement from reactors. Till 2030, the global supply deficit will be around 9,000 tonnes.

Commercial supplies of uranium peaked in 2021 at 65 million pounds—about 30% of the global supply—largely due to reduced usage during lockdowns. Since then, commercial supplies have declined significantly, dropping to just 17.5 million pounds in 2024, or roughly 9% of the global supply. Predictions indicate that 2024 will be the last year for nuclear operators to access substantial reserves. Commercial inventories are expected to fall below 7 million pounds, around 3% of the global supply, and remain low for the foreseeable future.

Risks to Consider

Policy and Regulatory

Uranium mining is subject to strict environmental regulations due to its potential environmental impact, e.g., radioactive waste management and water contamination remain concerns. Regulatory hurdles related to land use and environmental protection can delay or even halt projects, particularly in countries like the United States, where environmental regulations are stringent. Even without delays or shutdowns, the rising costs associated with compliance can make uranium mining less attractive for operators.

Geopolitical Risk

Kazakhstan's dominance in production places the global uranium supply chain at risk of political instability in Central Asia, geopolitical risk including its relationships with neighbouring countries, especially Russia and China can affect the global production of uranium heavily.

The relationship between Europe and Russia can also impact the global market as Russia’s potential export restriction to Western markets can significantly affect the European energy market which depends on Russia’s exports heavily.

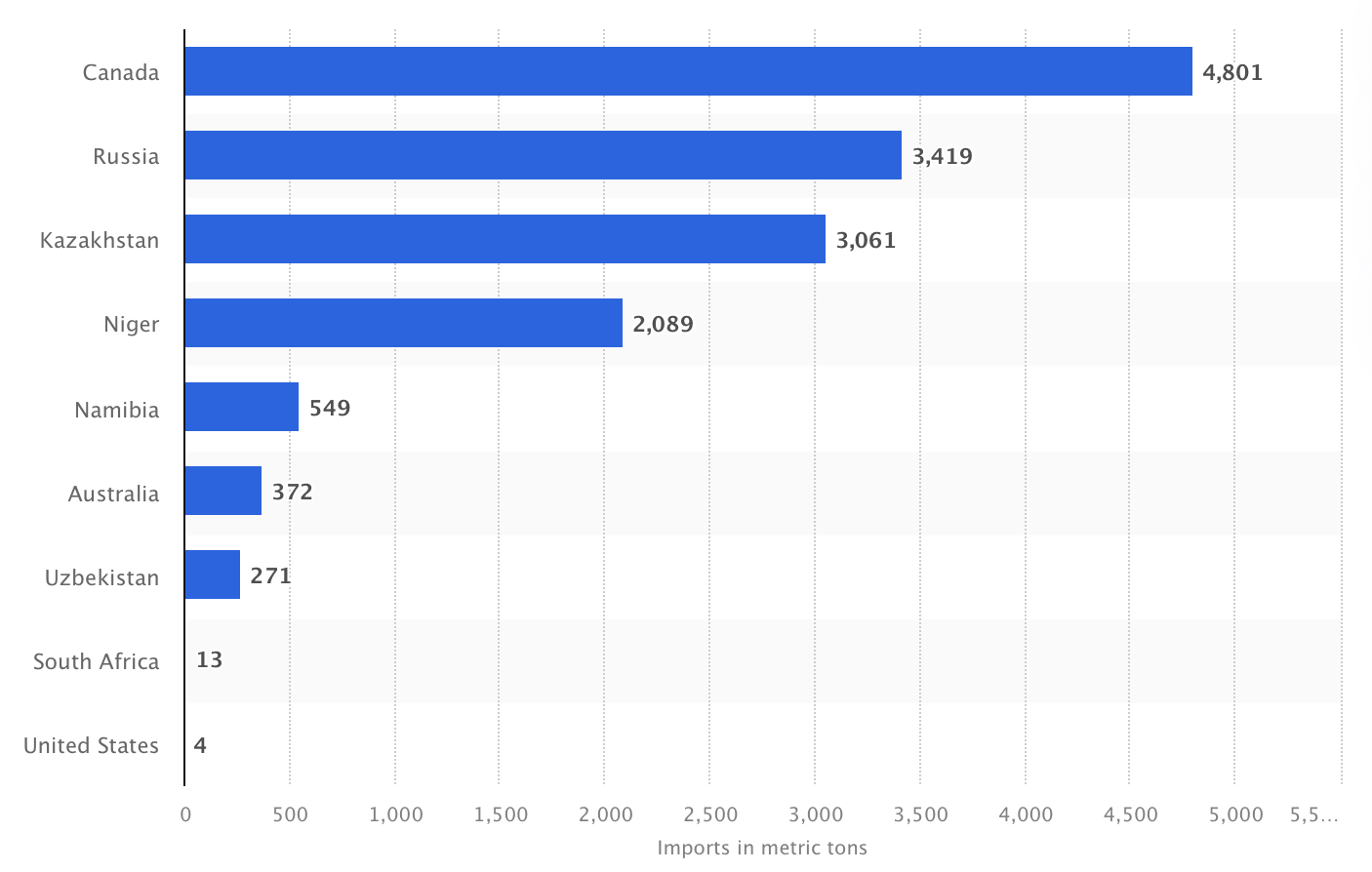

In 2023, 4,801 metric tons of natural uranium were imported into the European Union from Canada. Canada was accordingly the largest source of uranium imports to the EU that year. Russia followed closely in second, with more than 3,400 metric tons.