Lithium: The Fuel of Energy Revolution

Sep 27, 2024

Lithium Market

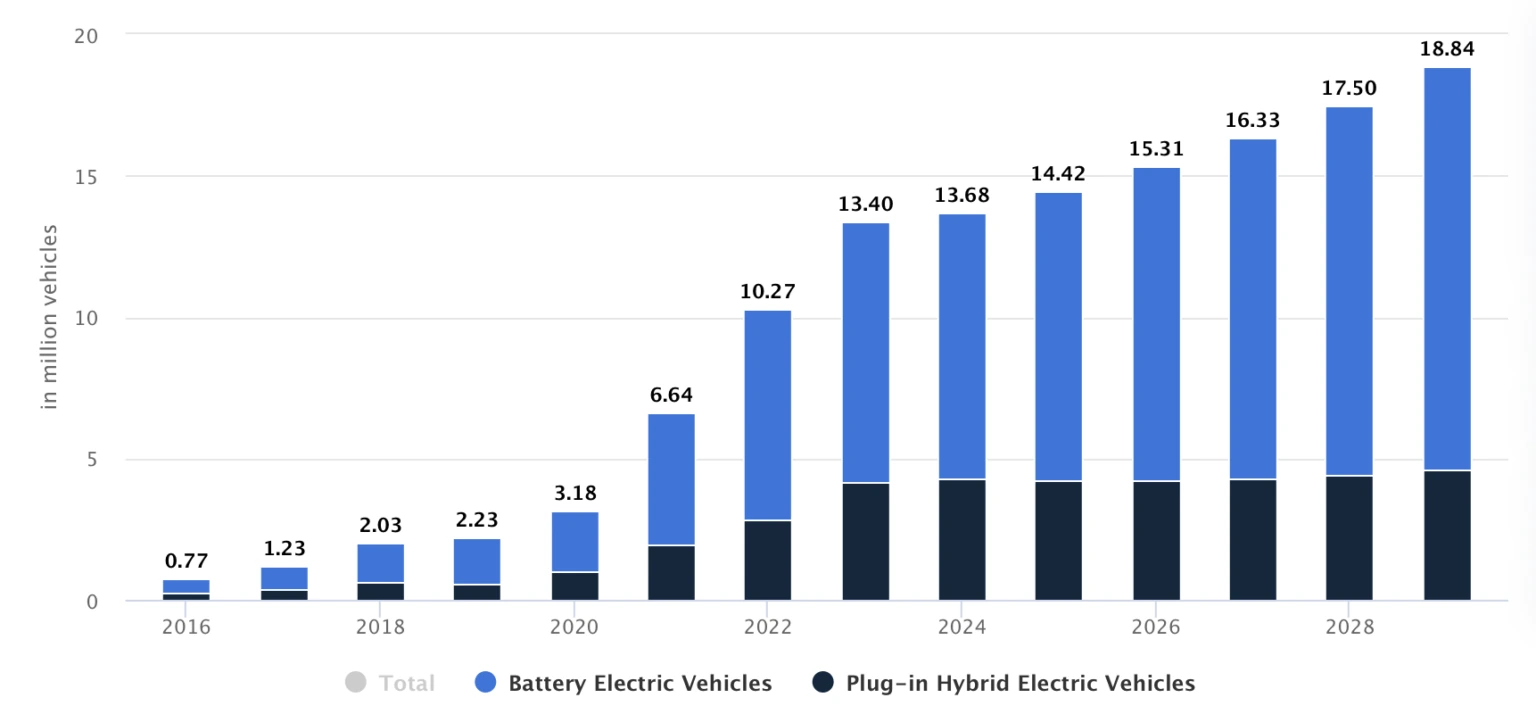

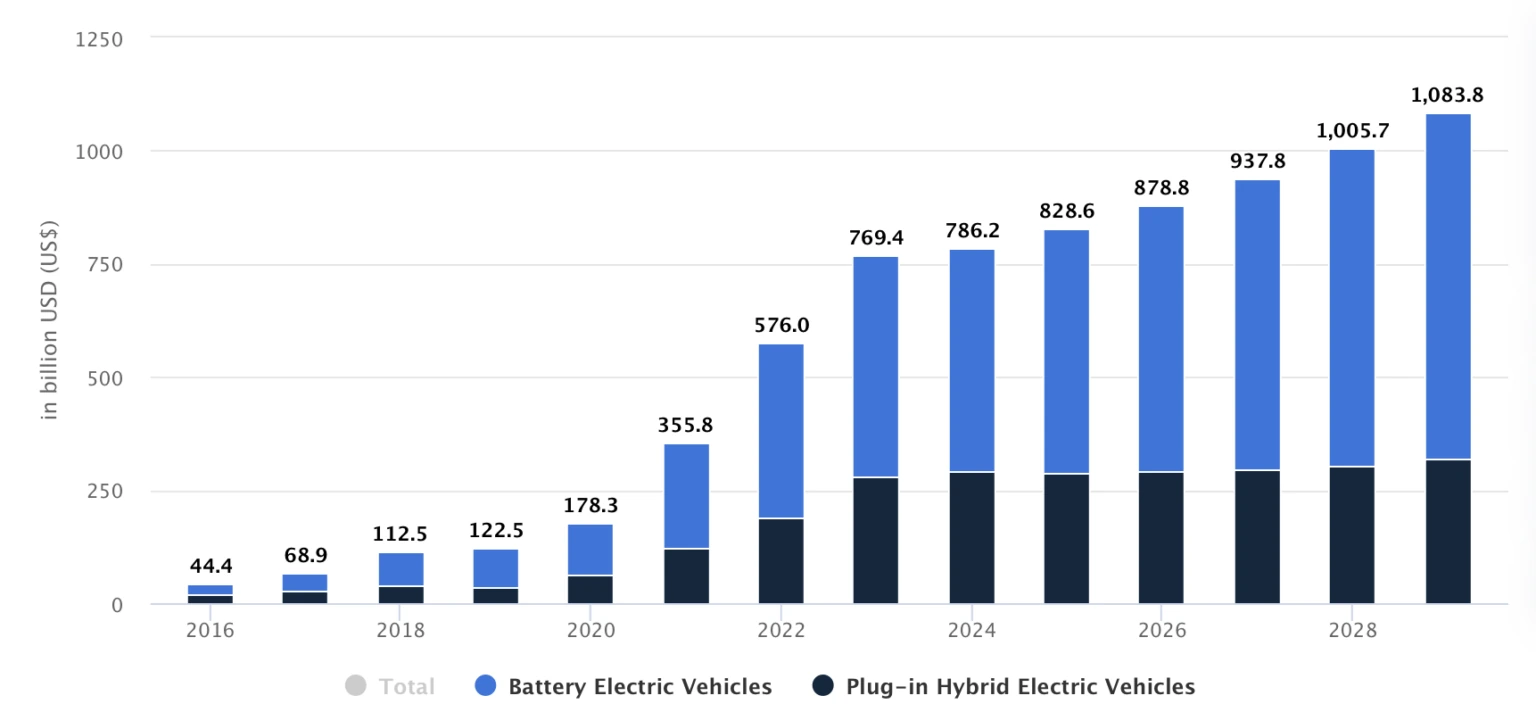

Expansion of the EV Market

In 2024, the revenue in the Electric Vehicles market is projected to reach a staggering US$786.2bn worldwide.

Looking ahead, it is expected that the market will demonstrate a steady annual growth rate (CAGR 2024-2029) of 6.63%, which will ultimately lead to a projected market volume of US$1,084.0bn by 2029. with unit sales of the EV market anticipated to reach 18.84m same year.

Lithium is the Key Material of EV Battery Cell

According to data from BloombergNEF, the cost of each cell’s cathode adds up to more than half of the overall cell cost. The cathode is the positively charged electrode of the battery and effectively determines the performance, range, and thermal safety of a battery, making it one of the most important components of an EV battery.

The Cost of a Battery Cell

EV Battery cell component | % of cell cost |

|---|---|

Cathode | 51% |

Manufacturing and depreciation | 24% |

Anode | 12% |

Separator | 7% |

Electrolyte | 4% |

Housing and other materials | 3% |

Source: visualcapitalist

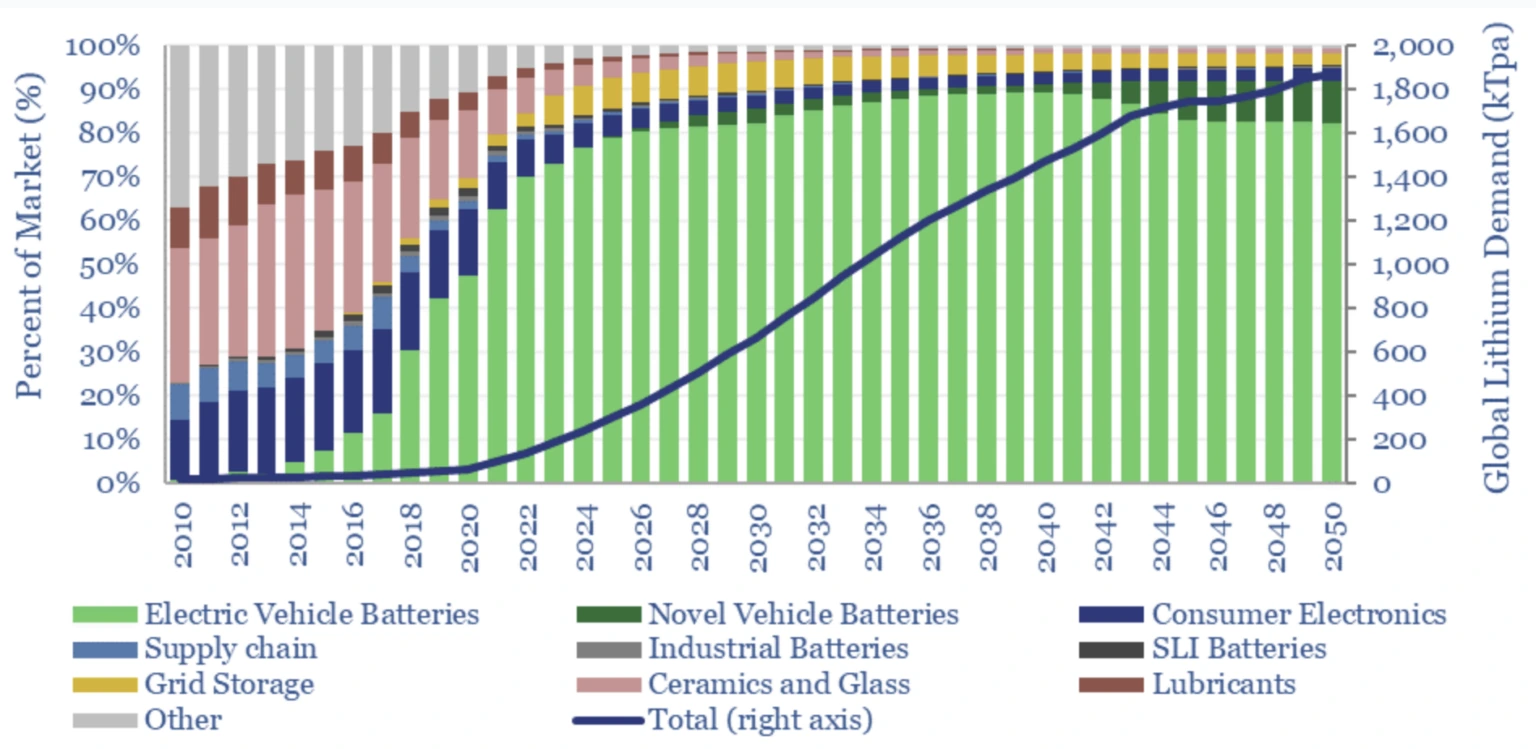

Lithium, as one of the main components of cathode, its overall market has been marked by a substantial increase in demand, with particularly accelerated growth in the last five years.

Source: Thunder Said Energy

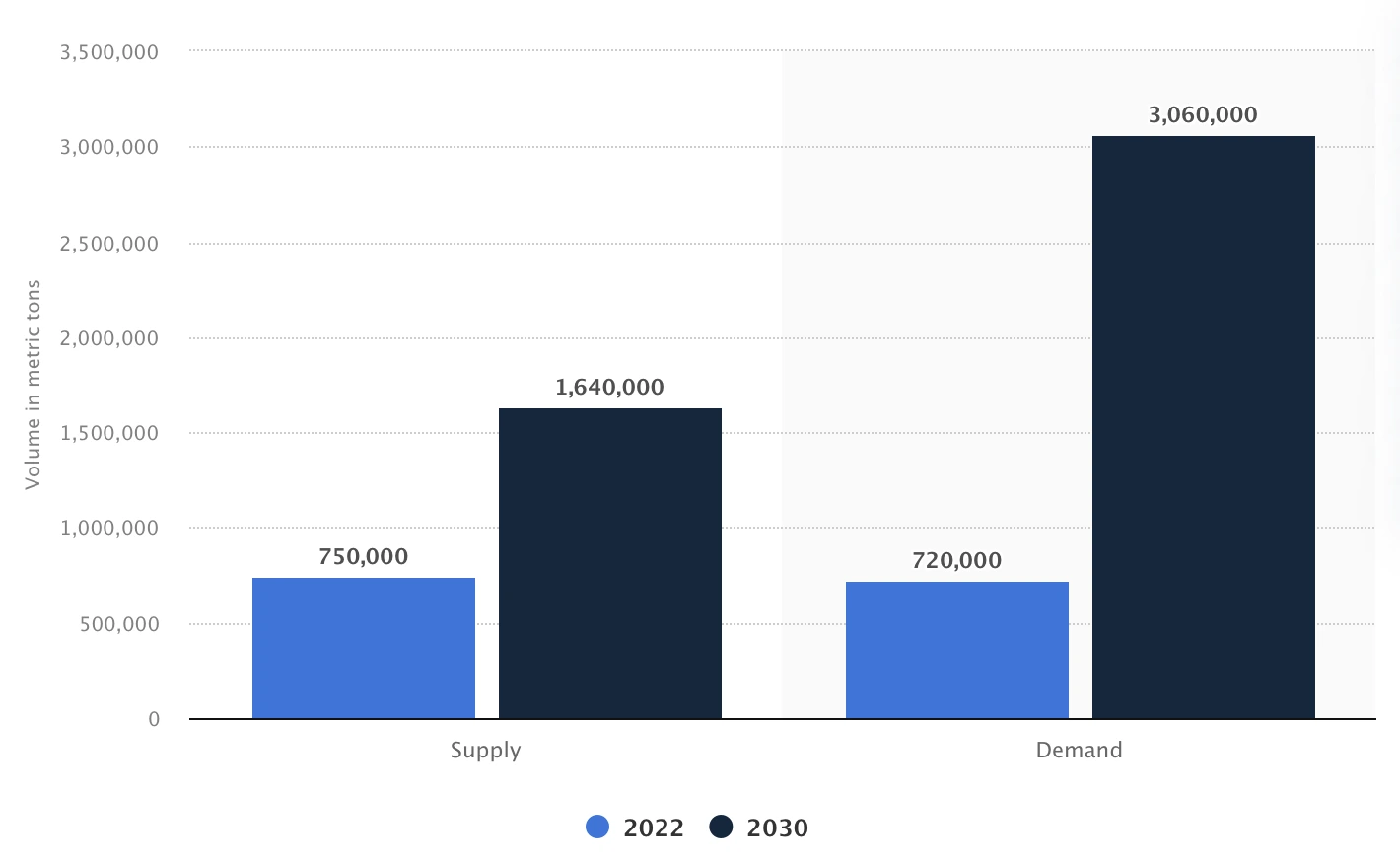

By 2030, global lithium demand is projected to reach 3.1 million metric tons, more than quadrupling from 0.72 million metric tons in 2022. Meanwhile, supply is anticipated to only double to 1.64 million metric tons, meeting just half of the total demand. Companies capable of providing substantial quantities of lithium over the next decade will be strategically positioned to benefit from the price increases driven by this rising demand.

Source: Statista

Lithium Sources: Brine Vs. Hard Rock

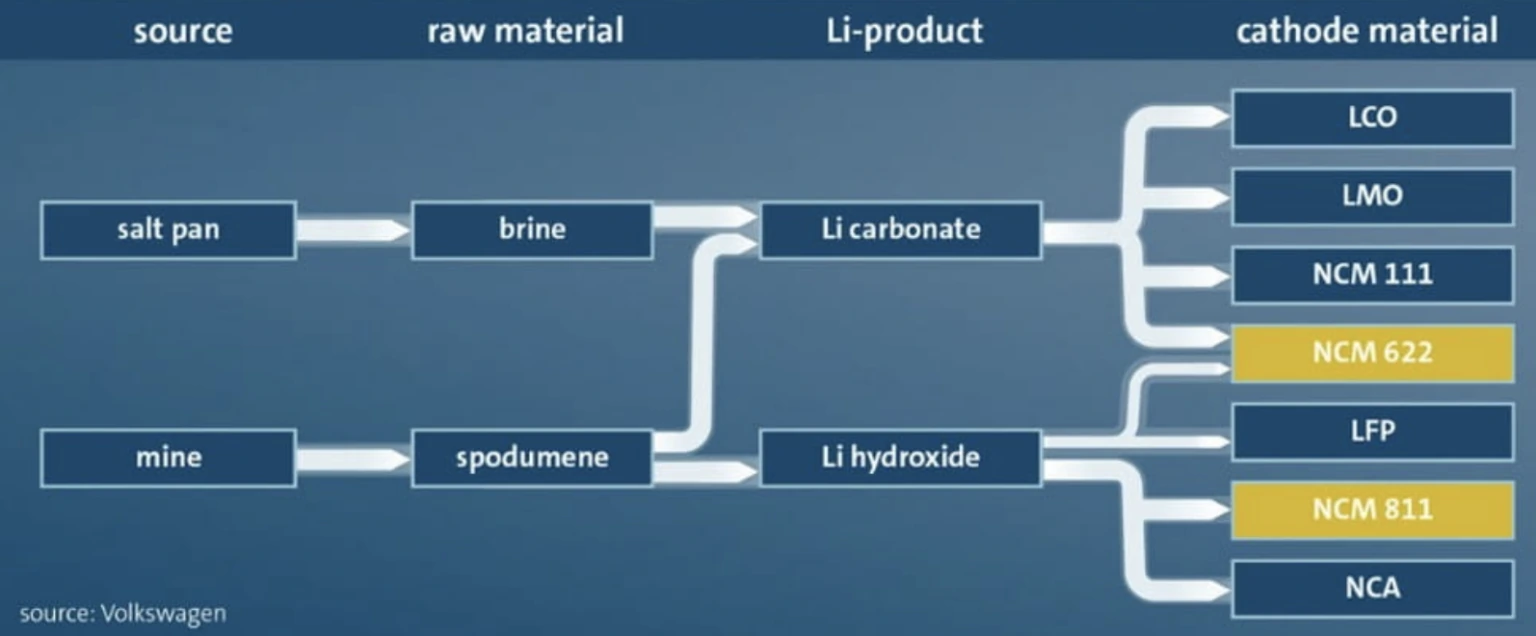

Lithium is primarily sourced from brine and spodumene, which are the raw materials containing lithium respectively extracted from salt pans and the hard rock mine. These two sources have distinct extraction and processing techniques, as well as final products. Brines initially can only be processed into Lithium Carbonate – Li2CO3 (possible to convert to Lithium Hydroxide – LiOH with additional cost), while spodumene can be processed both to lithium carbonate and lithium hydroxide, the latter being mostly applied given its higher price.

Source: New Age Metals

According to Benchmark’s Lithium Forecast, Hard rock sources of lithium, usually from spodumene deposits in Australia, currently make up 60% of the global mined lithium supply and are forecast to continue to do so through 2030, the rest 40% of the world’s lithium production comes from brine sources, primarily from South America’s “lithium triangle’’ including countries like Chile, Argentina, and Bolivia.

Market Preference for Spodumene

As there is an industry-wide push toward NCM 811 cathodes which have a higher energy density and can lead to a longer lifespan and a better driving range when used in EVs, lithium hydroxide (LiOH), better suited with NCM 811 cathodes, makes the hard rock mine that directly produces it looks more attractive to battery producers, resulting in higher demand of spodumene/hard rock mine in the market.

Extraction Methods

The extraction method of brine is considered more environmentally friendly, as it does not require drilling or blasting. However, the extraction process can take longer to complete. In contrast, the hard rock mining method involves drilling and blasting, which can negatively impact the environment. Nevertheless, the extraction process is generally quicker than that of brine.

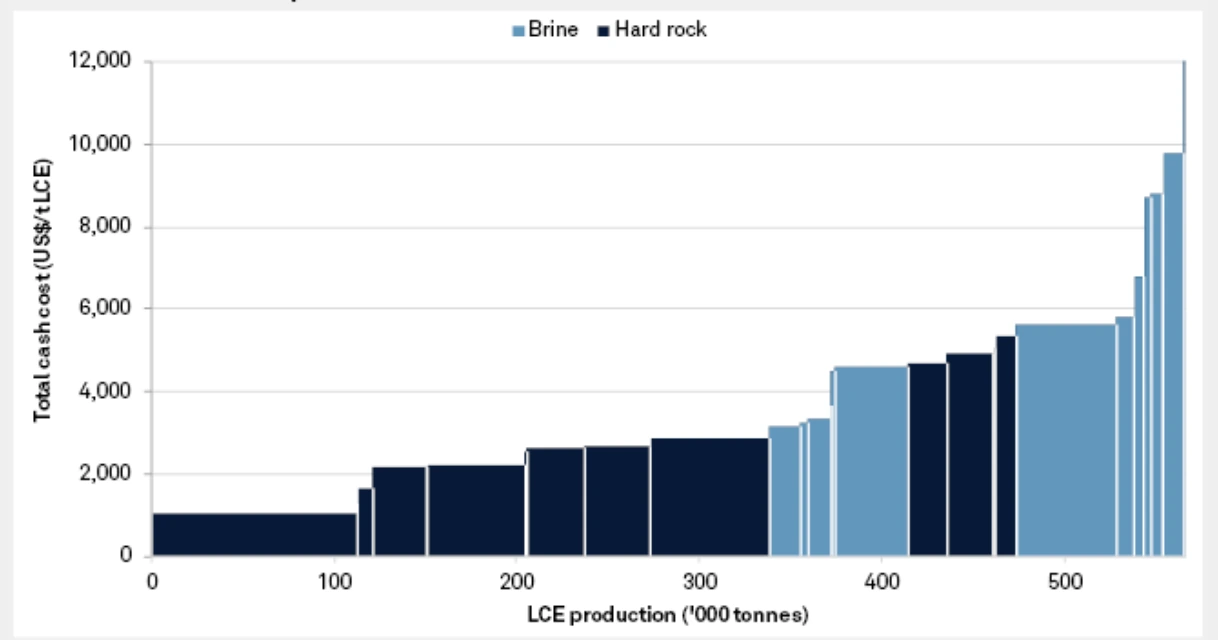

Extraction Cost

In 2019, the average total cash cost across 11 operating hard-rock producers was expected to be USD 2,540/t LCE, which is half of the USD 5,580/t LCE across nine brine operations, further increasing the market’s favour for the hard rock mine.

Source: S&P Global

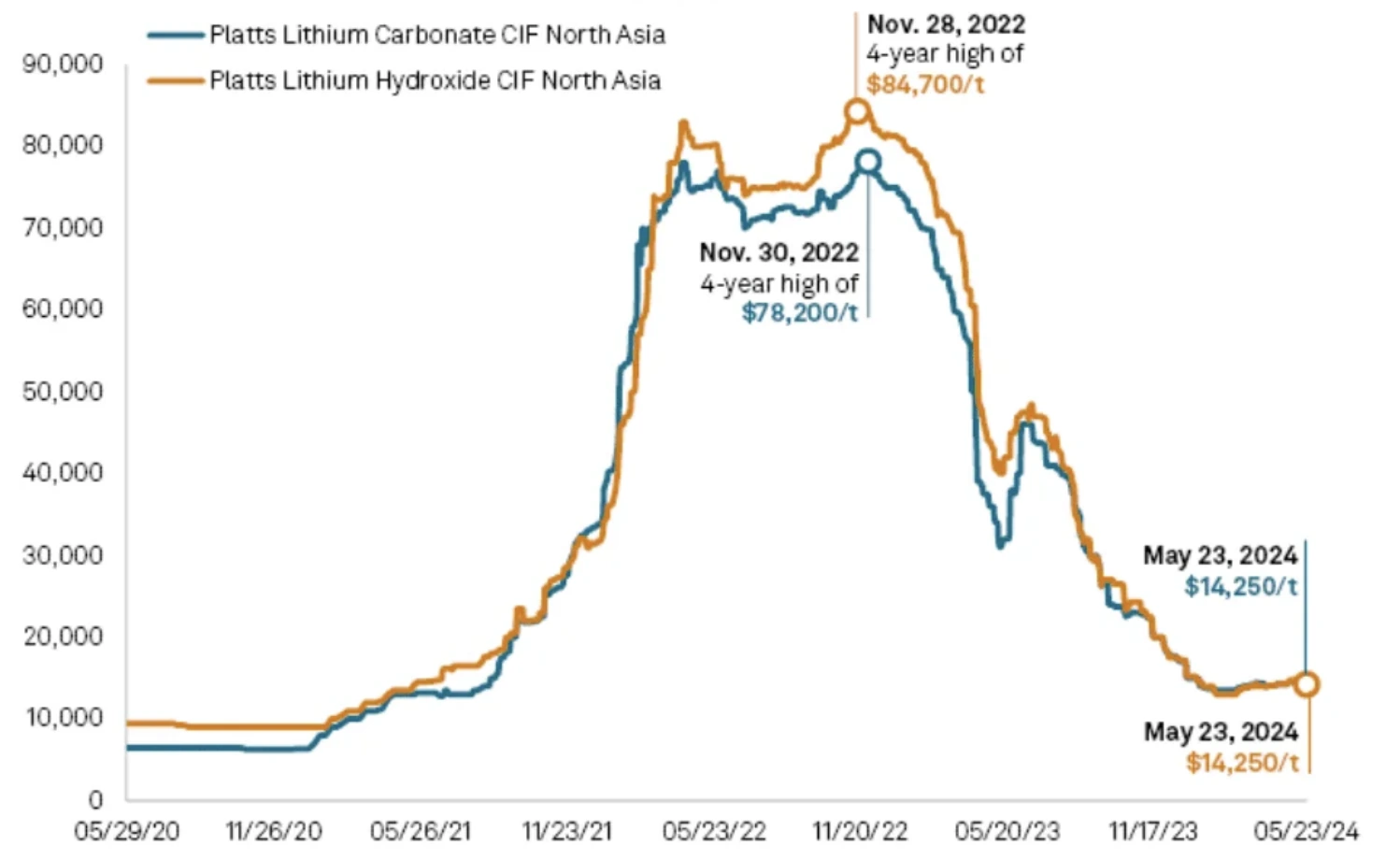

Overall Price Trend of Lithium

The price trends for both lithium carbonate and lithium hydroxide have followed a similar trajectory. The prices began to rise sharply in early 2021, driven by increasing demand from the booming EV sector and energy storage technologies. This upward momentum continued, and the price reached its peak at the end of 2022, reflecting strong demand and supply constraints.

The market then saw a sharp decline after the peak, likely due to increasing supply and easing demand pressures. Since then the prices stabilized at a lower level. Overall, the trend highlights a dramatic price surge during 2021-2022, followed by a sharp decline and subsequent sluggish price market for lithium miners.

Source: Carbon Credits

A New Source of Lithium: Claystone

In addition to the two main sources of lithium, claystone presents an alternative. While brine extraction is more sustainable but has a longer processing cycle, and hard rock extraction is faster but less environmentally friendly, claystone has the potential to balance both environmental considerations and extraction time. This extraction process avoids the need for drilling and blasting, as well as the lengthy evaporation process associated with brine extraction.

However, claystone extraction has not yet reached commercial production levels due to its lower lithium recovery rates compared to the other two sources, as well as the complexity and underdevelopment of its extraction processes.

A leader in Claystone Extraction: Century Lithium Corp

On September 23, 2024, Century Lithium Corp (TSXV: LCE), a Canadian-based advanced-stage lithium company, announced significant progress at its 100%-owned Angel Island claystone project in Nevada.

Angel Island Claystone Project

The Angel Island has a life of mine exceeding 40 years. It is expected to produce an average of 34,000 tons of battery-grade lithium carbonate annually.

Promising Results

The company achieved an impressive lithium carbonate purity of 99.5% in its assays from its Lithium Extraction Facility (Pilot Plant) in Amargosa Valley, Nevada, indicating a successful production of battery-grade lithium carbonate from its claystone project. These results enhance the likelihood of the viability and commercial scalability of its claystone project.

Lithium Carbonate Assay Results from Pilot Plant

Sample ID | Li2CO3 | Total non-Li | Sodium | Calcium |

Batch 2 #1 | 99.5 | 4,721 | 965 | 2,300 |

Batch 2 #2 | 99.5 | 4,778 | 566 | 2,200 |

Source: company official website

*Note: Independent analyses of product samples completed by SGS Canada.

Claystone Extraction Technology: Innovative and Sustainable

The company uses its innovative patent-pending process- chloride-based leach process to extract the lithium from the claystone coupled with Direct Lithium Extraction (DLE) process via Li-PROTM from Koch Technology Solutions, followed by Saltworks Technologies’ process to make battery-grade lithium carbonate. Additionally, the whole process is not tied to drilling or blasting.

Low Operating Cost

LCE’s low operating cost of $2,766/t after sales of surplus sodium hydroxide (NaOH), a bi-product of its chlor-alkali plant, makes it still competitive and profitable during the current sluggish lithium market.

Rover Critical Minerals, a Claystone Miner Next to Century Lithium Corp

Rover Critical Minerals (TSX: ROVR) is a Canadian-based junior mining company focused on its flagship claystone lithium project Let’s Go Lithium (LGL) located next to the Angel Island claystone project in Amargosa Valley, Nevada, a strategic location close to the world-class Albemarle Silver Lithium Peak mine, the only producing lithium mine in North America, and near the Tesla Gigafactory in Nevada.

The Let’s Go Lithium (LGL) Project

The project’s surface lithium grade reaches up to 1,218 parts per million (ppm), placing it above its comparable exploration-stage lithium projects. The ore body itself boasts a depth of up to half a meter from the surface, providing favourable extraction prospects compared to its peers. In terms of the lithium resource size, it is estimated between 4-8 million tonnes of lithium carbonate equivalent (LCE), although this is still to be confirmed through future drilling activities.

Exploration – Stage Comparable Companies; Data source: Refinitiv

Company | Market Cap (USD as of 24th Sep 2024) | Project Location | Stage | Project Size (acres) | Highest Surface Lithium Grade Li (ppm) | Depth of Ore Body from Surface (meters) | Lithium Resource Size (Million tonne LCE) |

|---|---|---|---|---|---|---|---|

Rover Critical Minerals (ROVR) | 1,053,956 | LGL & Longstreet, Amargosa Valley, NV | Pre-revenue, Pre-resource (surface sampling), Drill program under permitting | 13,000 | 1,218 | <0.5 | Pre-drilling (potential: 5-10) |

American Battery Technology Company (ABAT) | 62,689,349 | Tonopah Flats, Tonopah, NV | Pre-revenue, Preliminary Economic Assessment (April 2024) | 10,340 | 882 | 4 | 14.33 |

Noram Lithium Corp. (NRM) | 9,293,645 | Zeus, Clayton Valley, NV | Pre-revenue, Mineral Resource Estimate (May 2024) | 17,320 | 770 | 10 | 5.68 |

Pan American Energy Corp. (PRNG) | 3,974,221 | Horizon, Tonopah, NV | Pre-revenue, Mineral Resource Estimate (Jun 2024) | 17,330 | 800 | 18 | 10.00 |