Is Cryptocurrency the Green Gold?

Hong Kong, Sep 9, 2024

Gold has been a cornerstone of wealth preservation and investment for centuries, valued for its rarity, stability, and intrinsic value. However, the rise of cryptocurrencies, particularly Bitcoin, has sparked debates about whether gold’s dominance as a safe-haven asset is under threat among investors as there has been an increased level of investors using cryptocurrencies especially bitcoin as an “inflation hedge” or a store of value when facing an economy crisis or currency depreciation. Some even say Bitcoin is the “digital gold”. However, is that true?

Gold: Stable and Tangible

Gold’s history as a store of value dates back thousands of years, making it one of the most enduring forms of money. Its physical properties – durability, divisibility, and scarcity – have made it a reliable asset during times of economic turmoil, as it is immune to hacking, technological failures, or regulatory changes that could impact digital assets.

Unlike fiat currencies, gold’s value is not tied to any government or central bank, which makes it a preferred hedge against inflation, currency devaluation, or geopolitical risks.

The Rise of Cryptocurrencies: A Digital Challenger?

Cryptocurrencies, led by Bitcoin, have introduced a new paradigm in finance. Built on blockchain technology, cryptocurrencies offer decentralized, peer-to-peer transactions without the need for intermediaries like banks. This decentralization is appealing to investors seeking an alternative to traditional financial systems.

Bitcoin, often referred to as “digital gold” or “green gold”, shares some characteristics with gold, particularly its limited supply. With a maximum cap of 21 million, the scarcity of Bitcoin has driven its appeal as a store of value, especially among younger investors who view it as a hedge against inflation and a potential replacement for gold.

Favoured by Countries With High Inflation

In economies with high inflation or unstable fiat currencies, cryptocurrencies are becoming an important alternative for wealth preservation and daily transactions.

Argentina has been grappling with inflation rates consistently exceeding 50% annually, reaching 290% as of April 2024. The rapid devaluation of the Argentine peso (ARS) and restrictive foreign exchange controls have driven a surge in cryptocurrency usage in the country. According to the 2023 Chainalysis Global Crypto Adoption Index, Argentina ranked 15th globally for cryptocurrency adoption in 2023. Bitcoin, Ethereum, and stablecoins like USDT are commonly used as a hedge against inflation and currency devaluation.

Similarly, Turkey has also faced rising inflation, with rates surging and exceeding 85% in 2022, and remaining high in 2023 and 2024, albeit with some stabilization. The Turkish lira (TRY) has lost significant value, prompting many Turkish citizens to turn to cryptocurrencies like Bitcoin and stablecoins to preserve their wealth. According to the 2023 Chainalysis Global Crypto Adoption Index, Turkey ranked 12th globally for crypto adoption. A report by KuCoin found that 52% of Turkish respondents had used cryptocurrencies as of May 2023, reflecting the growing reliance on digital assets in the face of economic challenges.

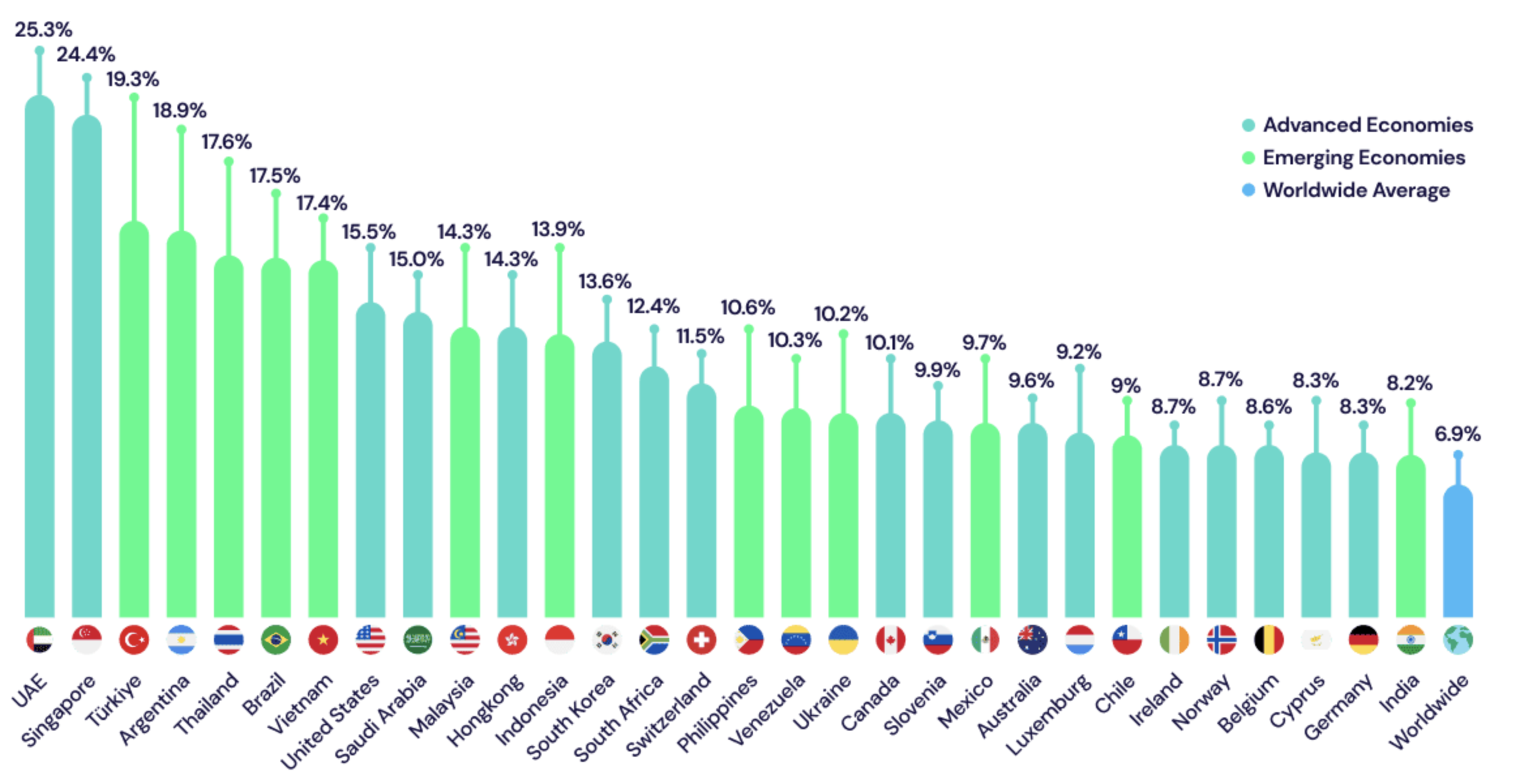

As of 2024, the estimated global cryptocurrency ownership is at an average of 6.8%, with over 560 million crypto owners worldwide. Notably, Turkey and Argentina rank among the top 10 countries in cryptocurrency ownership.

Cryptocurrency Owners Worldwide; Data TrippeA as of 2024

Market Cap Analysis

Gold

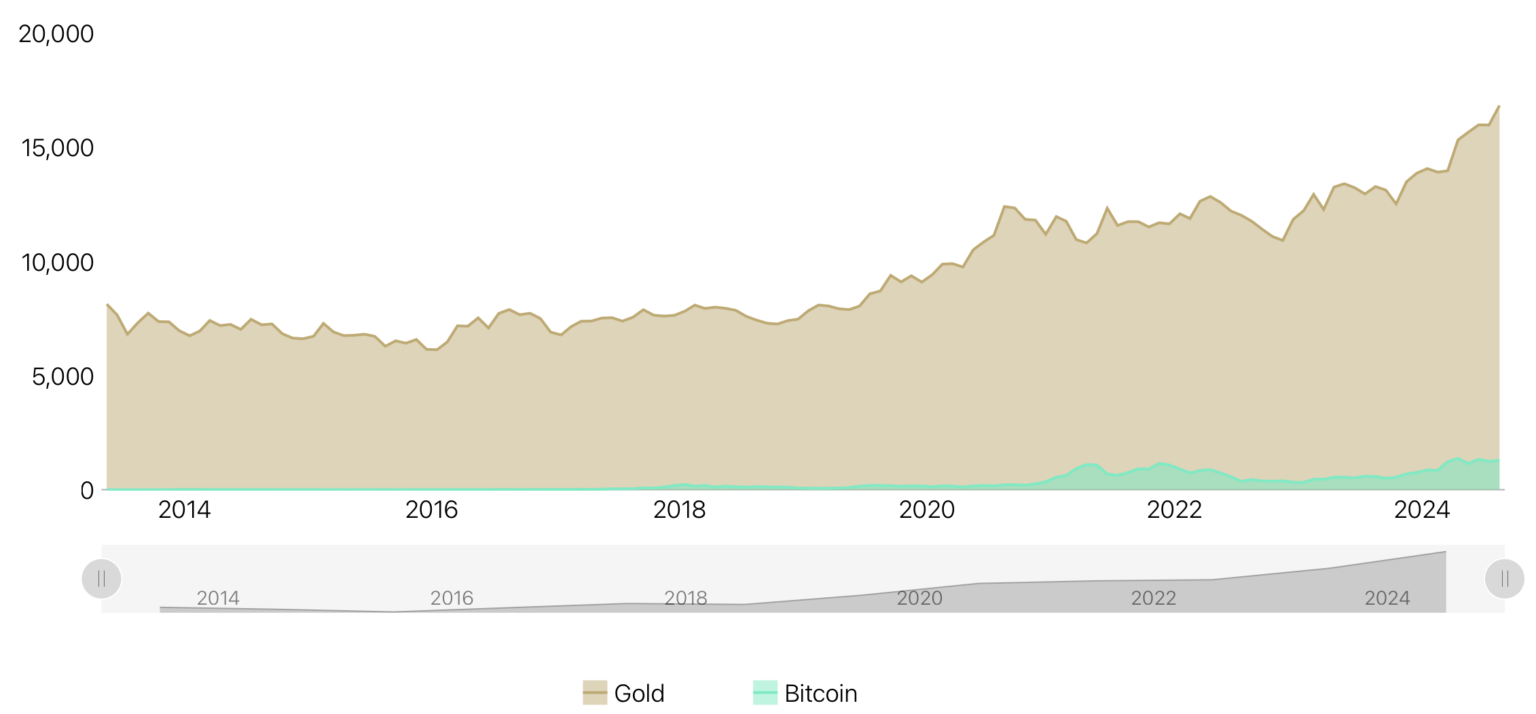

According to WCG’s estimate, approximately 209,000 tonnes of gold have been mined throughout human history in 2023, of which around two-thirds have been mined since 1950. As of July 2024, the market capitalisation of gold mined is estimated to be around $16 trillion.

Market Capitalisation of Gold and Bitcoin, in USD bn; Data Source: IGWT

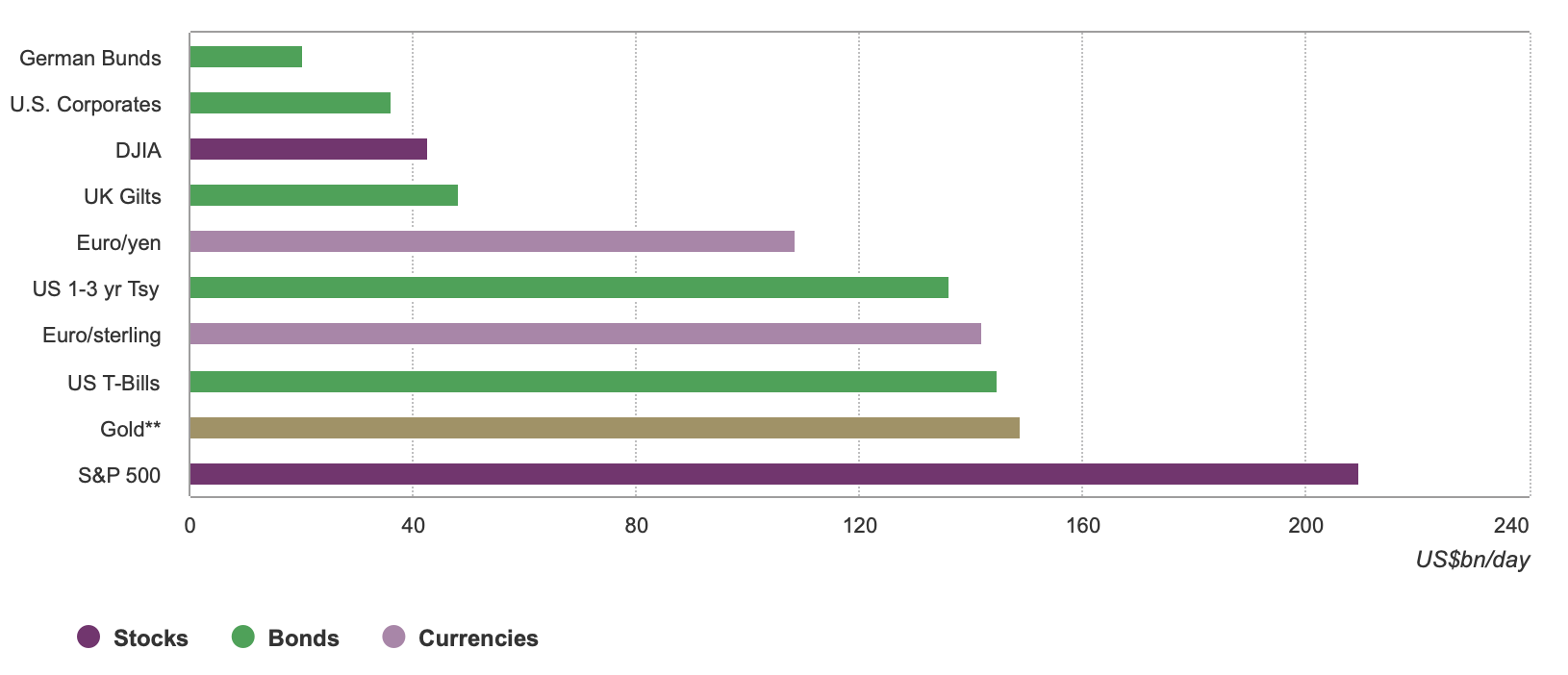

Due to gold’s ability to be recycled indefinitely, its liquidity in the market is unmatched by most financial assets. It is also the second most actively traded financial asset globally.

Major Financial Assets Average Daily Trading Volumes; Data WGC based on estimated average daily trading volumes from 31 December 2017 to 31 December 2022

Cryptocurrency

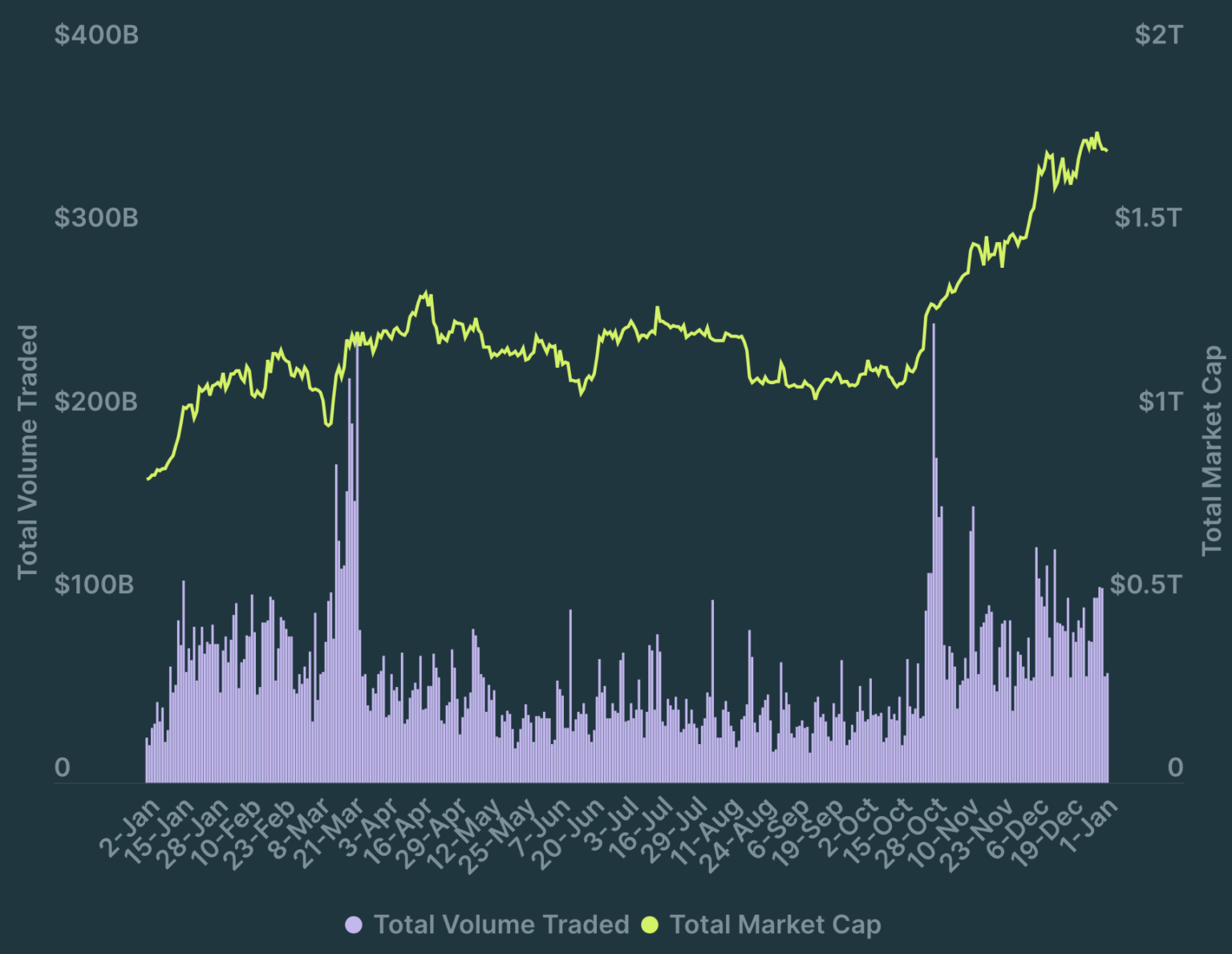

The total cryptocurrency market capitalisation fluctuates significantly due to the volatility of the market. According to Coin Market Cap, its Market Capitalisation rose +108.1% in 2023, From $829B to $1.72T, and ended up with around $1.98T as of Sep 2024, with Bitcoin’s $1.11T market cap, accounting for over 50% of that. The total cryptocurrency market cap has been doubled in 2023, or $869B in absolute terms.

Total Cryptocurrency Market Cap & Spot Trading Volume, 2023; Data Source: CoinGecko

Although the adoption of cryptocurrency has increased in recent years, especially for countries with high inflation, its market capitalisation is still low compared to gold, approx. 10% of the gold market cap.

Intrinsic Volatility and Correlation Comparison

Cryptocurrencies have delivered astronomical returns for early adopters and protections for investors in regions with unstable fiat currencies or high inflation.

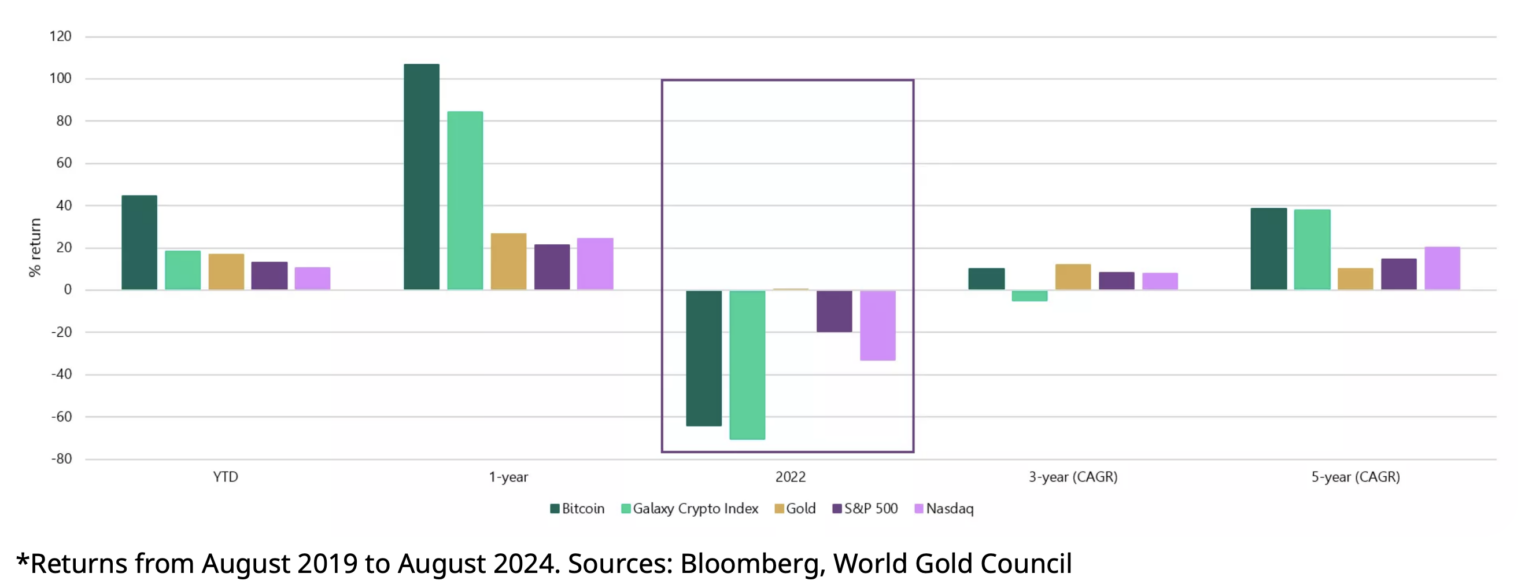

Bitcoin’s Higher Return; Data Source: WGC

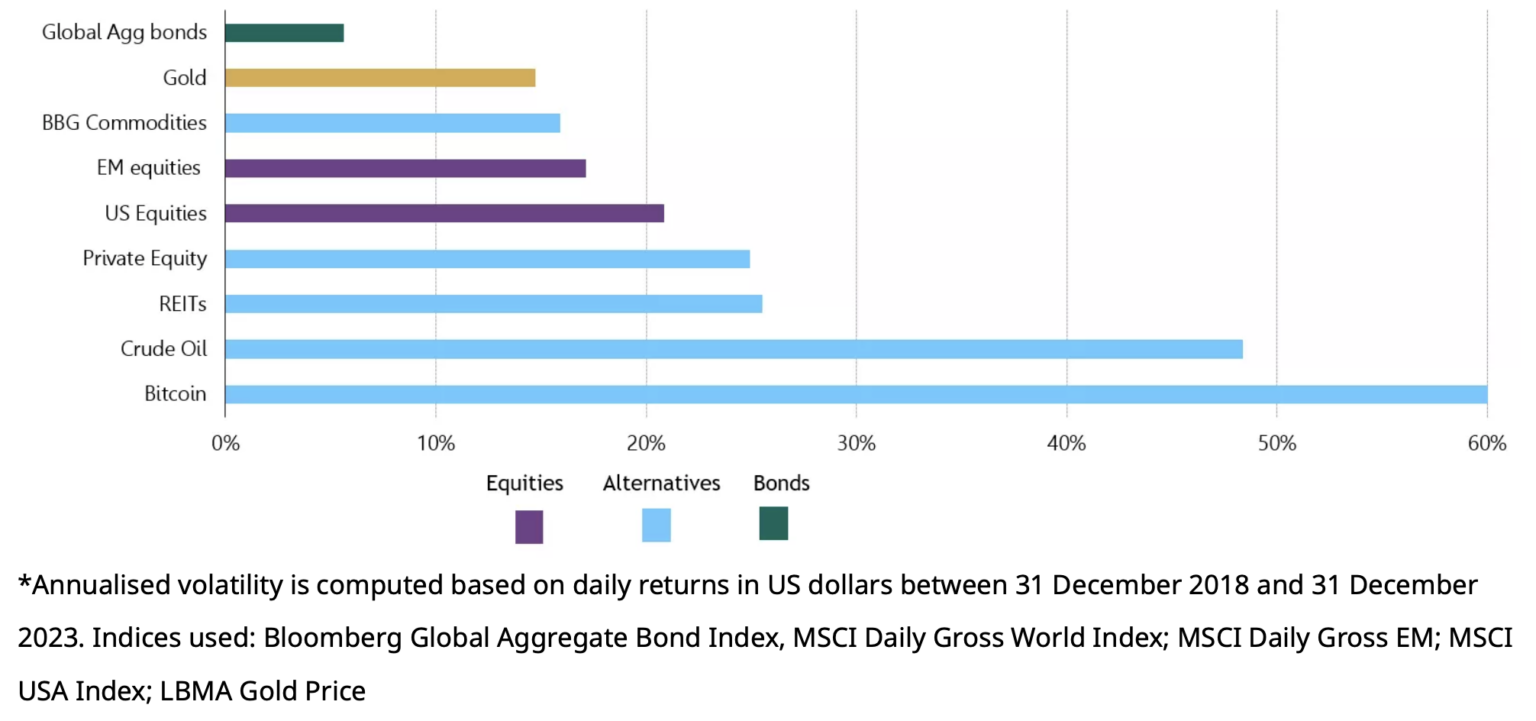

However, this comes with significant volatility. The price of Bitcoin, for instance, has seen massive fluctuations. Unlike gold, which is known for its stability, cryptocurrency can experience extreme price swings, making it more suitable for risk-tolerant investors.

Major Asset 5-Year Average Daily Volatility – Annualized; Data Source: WGC

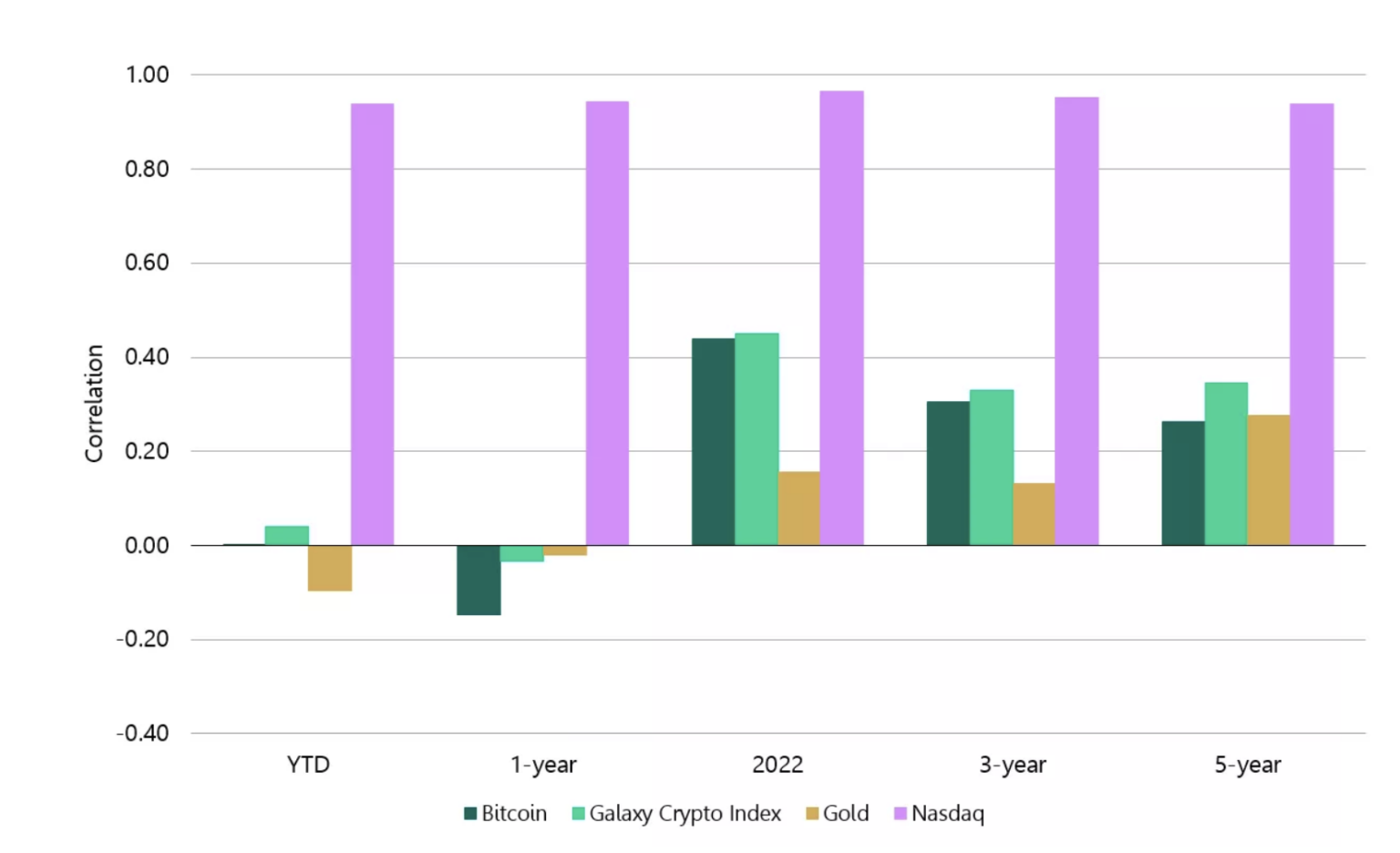

Additionally, gold performs much better in correlation with the market. Gold’s performance provides a positive correlation in up markets, and a negative correlation in down markets, which is a perfect characteristic as a safe-haven asset for investors. The performance of cryptocurrency during economic downturns is less predictable compared to gold. Further, gold has a lower correlation with the equity market compared to bitcoin especially when analysed in a longer period.

Historical Correlations to S&P 500; Data WGC as of 9 August 2024

While cryptocurrencies have undoubtedly disrupted traditional finance and introduced new investment opportunities, gold’s long-standing role as a safe-haven asset is far from over in the near term with its lower volatility and correlation and compelling feature – physicality. The two asset classes serve different purposes and appeal to different types of investors. Rather than being outright competitors, gold and cryptocurrencies can coexist, offering a diversified approach to wealth preservation and growth. As the debate continues, investors would do well to consider both assets in their portfolios, recognizing the unique strengths each brings.