EV Market: How Will China EVs Tackling EU Tariffs

Shenzhen, Jul 5, 2024

The Electric Vehicle (EV) market in Europe has seen significant growth in recent years, driven by customer preferences, supportive policies and government initiatives. This growth presents an excellent opportunity for Chinese EV manufacturers to open new market and expand their business as intense competition is happening in China. With the notable price advantage of Chinese EVs over European models, Chinese manufacturers seem to be well-positioned to capitalize on this growth and achieve success internationally.

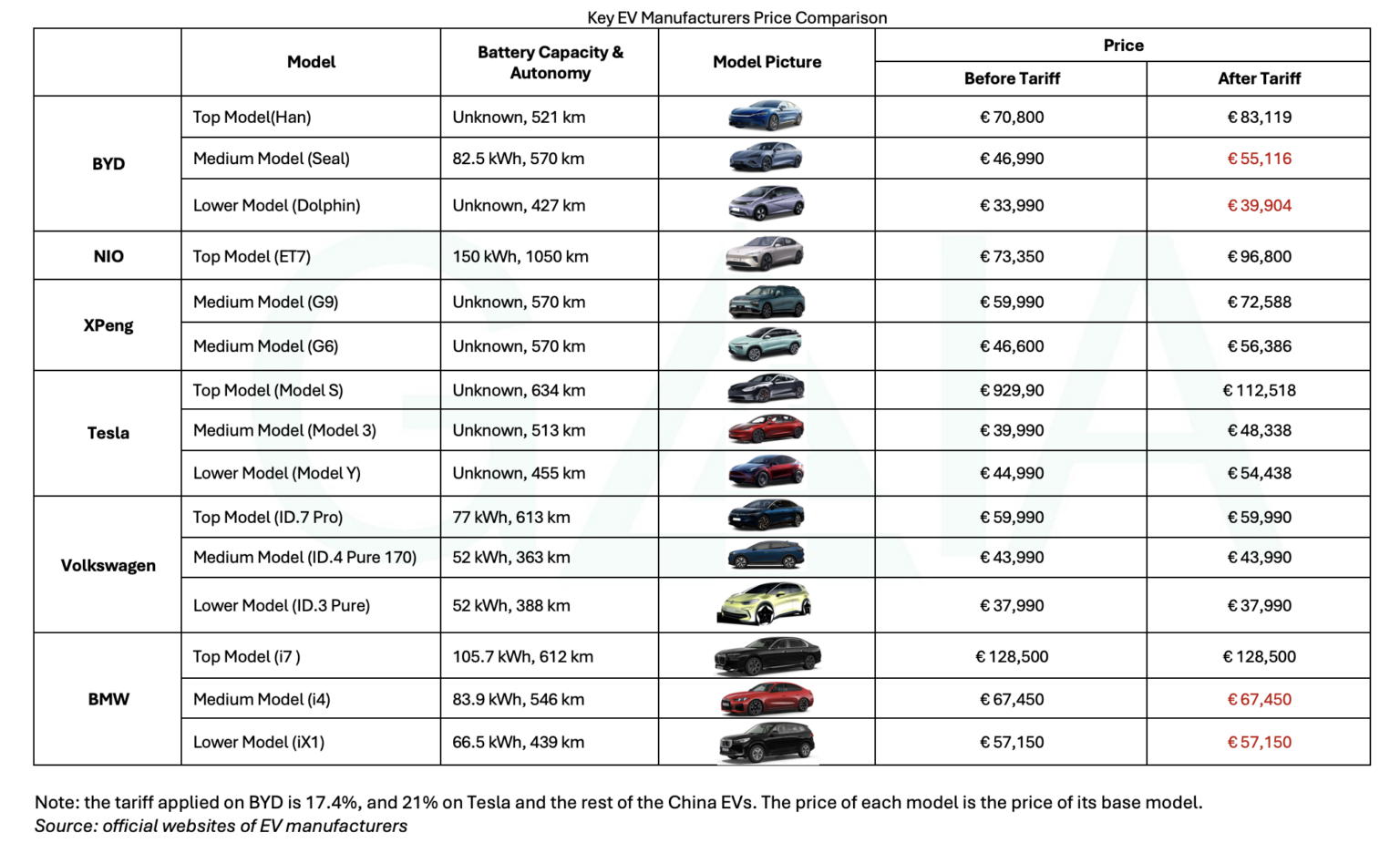

However, on June 12th, the European Commission (EC) announced provisional import duties on China-made EVs ranging from 17.4% to 38.1%, depending on the automaker. Those duties are on top of existing 10% tariffs. The individual duties the Commission would apply to the three sampled Chinese producers would be:

BYD: 17.4%

Geely: 20%

SAIC: 38.1%

Other BEV producers in China that cooperated in the investigation would be subject to 21%. All other BEV producers in China that did not cooperate in the investigation would be subject to 38.1%.

The Chinese automakers that cooperated with the European Commission’s investigation are Aiways, BMW Brilliance, Changan, Chery, Dongfeng, FAW, Great Wall Motor (GWM), JAC, Leapmotor, Nio, and Xpeng. These manufacturers will receive an additional 21% duty.

The imposition of high tariffs on Chinese EVs by Europe raises the question: will this price advantage continue?

Global EV Market Overview

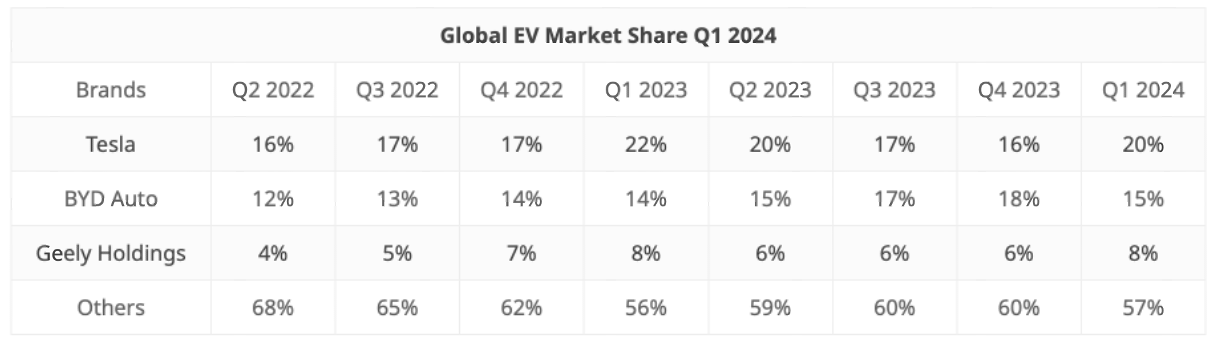

In 2023, the top 10 Battery Electric Vehicle (BEV) companies constituted 65% of the overall market. In 2024 Q1, Tesla, with a 20% market share, leads the global EV market, followed by Chinese EV brand—BYD at 15%.

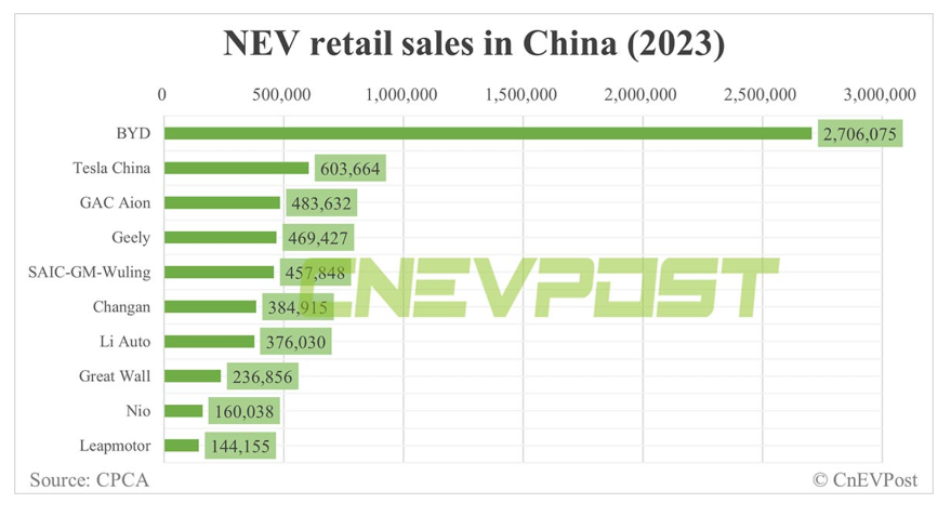

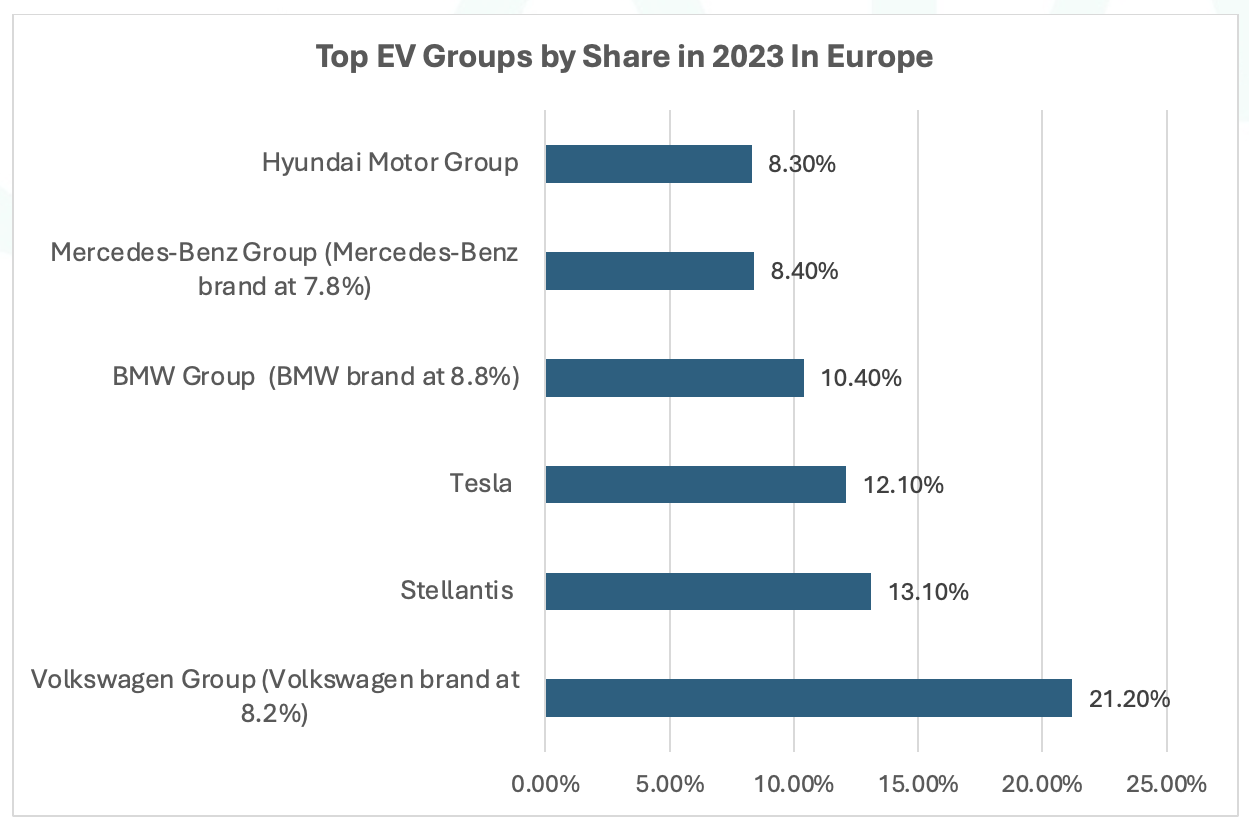

In China, BYD dominates with a 35% market share, while Tesla holds 7.8%, Nio 2.1%, and Li Auto 4.9%. The European EV market is led by Volkswagen with 21.2%.

Source: visualcapitalist, counterpoint

Source: CNEVPOST

Source: insideEVs

Challenges in the Chinese Domestic Market

The domestic Chinese EV market is rapidly approaching saturation, with over 200 manufacturers including 39 notable names competing for a limited pool of consumers. Chinese EV manufacturers are engaged in a highly competitive market where price reductions have become a common strategy to attract consumers. Intense domestic competition and frequent price reductions can lead to diminishing returns, bring difficulties for manufacturers to cover production costs, invest in research and development, and sustain long-term growth, thus making the price war unsustainable without market expansion.

To mitigate risks associated with intense domestic competition and achieve economic scalability, Chinese EV manufacturers started to look beyond their borders. Entering a new market is essential for sustaining growth and revenue streams.

The European Market Potential

Europe’s stringent emissions regulations brings the growing demand for electric vehicles, making it a lucrative market for Chinese manufacturers. With the U.S. market effectively closed off due to a 100% tariff, Europe remains the most viable option for Chinese EV producers.

Price Comparison: Chinese vs. European EVs Post-Tariff

Understanding how Chinese EVs perform in terms of price comparison with European EVs after the tariff is crucial. Please refer to the last page of the article for a detailed comparison of high, medium and low-end models respectively from leading Chinese EV manufacturers and European ones, considering the newly imposed tariffs.

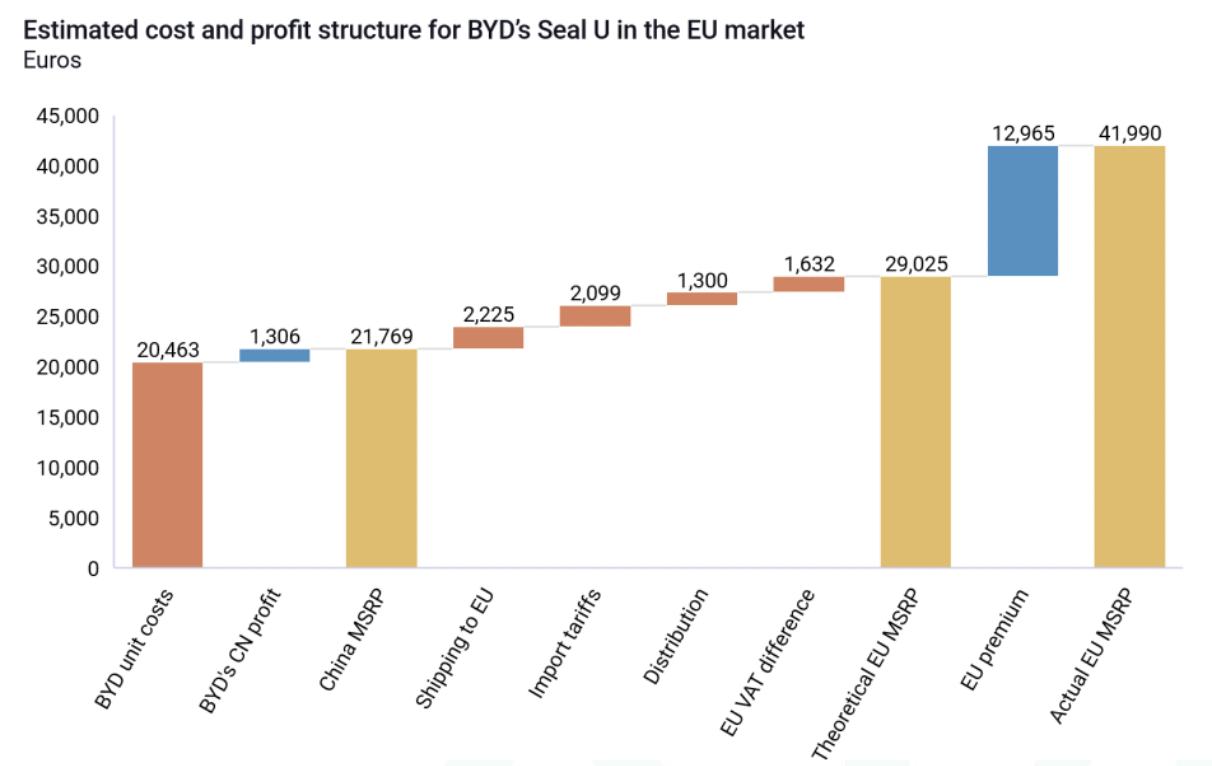

With comparable car performance including battery capacity and range, Chinese medium and lower-end models—BYD Seal (18.3% lower to BMW i4 ) and BYD Dolphin (30.2% lower than BMW iX1) still maintain a price advantage after the imposition of EU tariffs. This advantage is further magnified by BYD’s pricing strategy in Europe, since it includes a significant price premium in Europe (EU premium), which allows for substantial flexibility. Should the tariffs become so high that BYD’s price advantage diminishes, the company can still retain its competitive edge by adjusting and reducing the EU premium accordingly.

Source: RhodiumGroup

So, despite the imposition of tariffs, Chinese EV manufacturer BYD can still maintain a price advantage on their medium and lower-end models— BYD Seal and BYD Dolphin in the European market. The new tariff will do little to slow down BYD’s expansion in Europe, offering a pathway for BYD to achieve economic scalability and secure its position as key player in the global EV market and a solution for Chinese EV manufactures to mitigate risks of intense domestic competition. Further, global adoption of EVs is inevitable to achieve carbon neutrality targets, which sets an undisputable foundation for long-term rising demand of energy metals, much needed to power the electric fleet of the energy transition era.