Copper’s Surge: Unpacking Market Dynamics and the Impact of the Green Transition

Paris, Jun 6, 2024

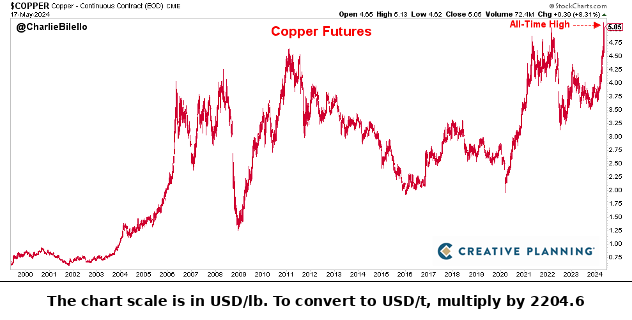

The copper price has recently reached a new all-time high, at 11,104USD/t on May 21st, 2024, 29% higher from year-end 2023. It has then faced a 9% correction, and is now back to 10,089USD/t (June 3rd).

A price at an all-time high, really?

In nominal terms, the price of copper has indeed reached an all-time high, while previous highs date back to March 2022 (10,845USD/t), and May 2021 (10,745USD/t).

However, a more accurate historical comparison is to use the real price, i.e. adjusted for inflation. The most recent high dates back to February 2011 with a price of 14,012USD/t, 26% above the recent record, and even 15,000USD/t back in 1968.

Note that during the commodity supercycle (2000-2014), the inflation-adjusted price of copper reached 12,000USD/t (8,000USD/t in nominal terms).

All other things being equal, the price of copper would have to rise significantly (>20%) for this to have a real negative impact on the economy.

Is the market telling us something?

I have been a close observer of the commodities market since the early 2000s, and my experience is that you should not draw definitive conclusions from a given price level, and even less so from extrapolating a price trend.

If we take the simple example of oil, in the first half of 2008, when its price (Brent) was heading towards 140USD/bl, some brilliant economists and strategists were predicting an oil price of between 200 and 300USD/bl. Since then, oil prices have traded in a fairly wide range between 30 and 120USD/bl, and currently stands at 80USD/bl.

But back to copper.

The importance of this metal in the economy, due to its widespread use in buildings and infrastructure, transport, power grids, industrial machinery and household appliances, makes it an early indicator of global economic health, leading traders to call it Dr. Copper.

The reality is a little more complex. Movements in copper prices certainly reflect developments in the global economy, but also the supply situation, and even, more difficult to grasp, market sentiment and anticipations regarding the health of the economy.

So, what’s the current situation?

Global economic growth, as measured by GDP, is expected to increase by almost 3% in 2024, steady, but below long-run average. The J.P.Morgan Global Manufacturing PMI, which provides indication of world manufacturing business conditions, reached a 22-month high at 50.9 in May, from depressed 2023 levels. It remains well short of the 54-55 levels reached in 2021, but it is worth noting that output, new orders and employment PMI are improving. The situation in China, which accounts for over 50% of copper demand, remains complicated. The country continues to suffer from the worst real estate recession in recent history. Business figures remain disappointing, prompting the authorities to introduce new support measures, notably to revive the real estate sector.

While the risk of recession in the USA and Europe in 2023 has been averted (or postponed?), the global economy is not yet strong enough in itself to create a positive demand shock for copper. But it may not be this part of the demand that matters.

The subject of energy transition is well identified and documented and will come as no surprise to anyone. However, the volumes of so-called green demand (i.e. commodities used to achieve this energy transition) are starting to become significant.

Electric vehicles, solar and wind power, energy storage and recharging infrastructures are currently creating an additional demand for copper of around 3Mt, or 9% of total demand. This is an impressive growth driver for copper, as its demand is set to double over the next 5 years, an average growth rate of 15% per year, and should account for 15-20% of global copper demand by then. It is still early days, but widespread AI adoption and its need for datacenter is likely to add growth to power consumption and copper demand.

China plays a key role in this green demand. It accounts for 55% of global green copper consumption. This is largely due to its technological lead and mass production in solar energy and electric vehicles. These 2 sectors account for 75% of Chinese green demand, and over 40% of global green demand.

In fact, 60% of copper demand growth comes from green copper. The speed of development of the energy transition plays a greater role in the price of copper than that of the global economy.

What about the supply situation, i.e. mining production?

The copper industry has a long history of production interruptions, the latest of which is no mean feat. It concerns the Cobre Panama mine, operated by First Quantum Minerals. Its production, which represents 1.5% of global mining output, has been suspended since November 2023, when the Supreme Court of Justice of Panama declared unconstitutional the law that authorized the renewed concession contract. To date, it is impossible to say when production will restart, even if it is in the interests of all stakeholders. When production resumes, it will likely lead to a short-term correction in copper price. This case is typical of the thorny relationship between host countries and mining companies.

This is in addition to the lack of new projects in mining production: geological constraints (lower grades), growing awareness of ESG criteria (restricting access to capital and increasing environmental requirements, particularly on the subject of water, a source of additional capex), lower IRRs. There have never been so few new projects sanctioned as since 2020.

It’s easy to see why BHP Billiton tried to buy Anglo-American. The new group would have controlled 11% of the world’s copper production. A potential deal that was well received by the market.

Are we on the verge of a price explosion?

The sharp rise in prices since the start of the year has more to do with a combination of factors: a relatively low price at the end of 2023, a resilient global economy, the prospect of a rate cut to stimulate demand, short-term supply constraints – all of which led traders to take very long positions at the start of the year, amplifying the rise in prices. It is the effect of investor sentiment, speculation and algorithmic trading that impacts the price and volatility of many financial assets, of which copper is no exception.

Today, there are no fundamental reasons to expect this trend to continue in the short term.

Over the next few years, rising demand linked to the energy transition will provide natural support for copper prices and limit correction phases (i.e. higher lows). Average annual prices are likely to rise. But do not forget that price peaks are never positive for commodities, as they always drive demand substitution and unexpected supply (mostly recycling and hidden storage, but also new technologies), ending in boom and bust.

About the author: Emmanuel’s LinkedIn profile