Copper M&A Landscape: Junior Companies to Watch

Hong Kong, Aug 16, 2024

Copper, often referred to as the "metal of the future", is a cornerstone of the global economy. Its exceptional conductivity and durability make it indispensable in various industries, including construction, electronics, renewable energy, and transportation. As the world shifts towards electrification and sustainable energy, copper’s role has never been more critical.

The copper industry has experienced transformations, particularly through mergers and acquisitions (M&A). These activities are reshaping the competitive landscape, and creating investment opportunities. This article delves into the current copper market, and recent M&A trends, and offers insights into which companies are positioned as attractive investment targets.

The Copper Market: Drivers of Increased M&A Activity

The demand for copper is driven by several factors, including the global transition to renewable energy, the electrification of transportation, and ongoing urbanization in emerging markets. Copper’s role in electric vehicles (EVs), solar panels, and wind turbines underscores its importance in the green energy revolution. As these sectors expand, the demand for copper is expected to rise significantly.

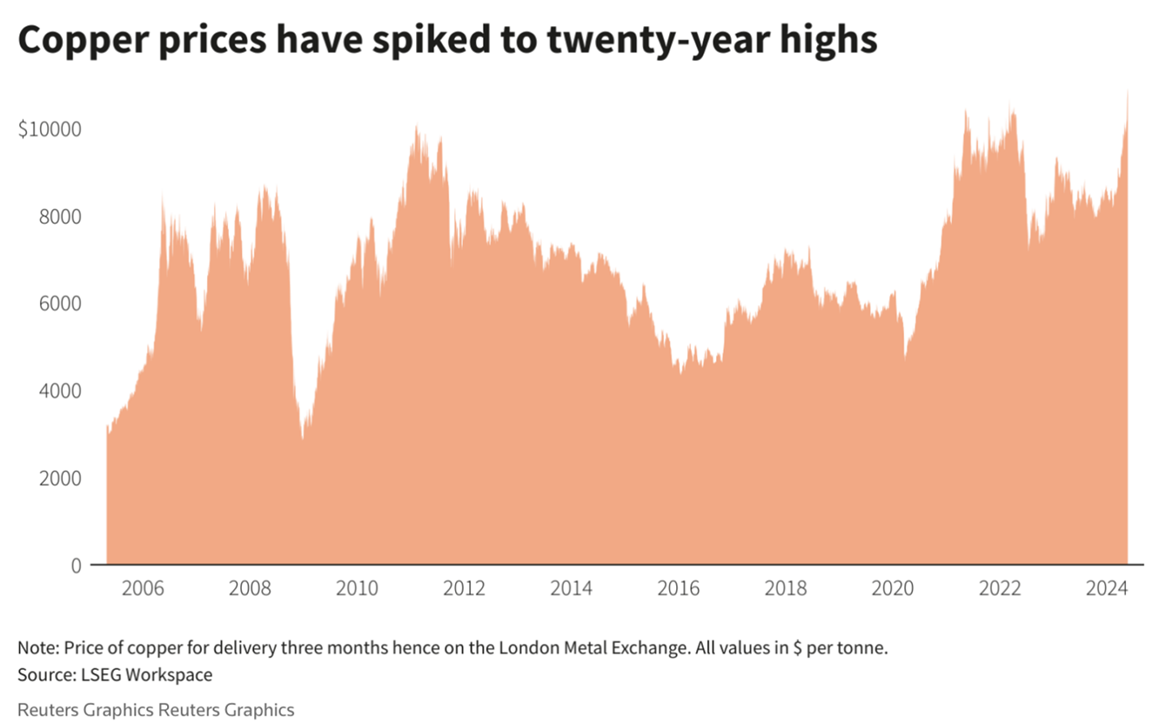

On the supply side, copper production is concentrated in a few key regions, including South America, particularly Chile and Peru, which account for a significant portion of global output. However, challenges such as declining ore grades, environmental regulations, and labour strikes have constrained supply growth. High demand with constrained supply has brought the twenty-year highs of copper prices.

Source: Reuters

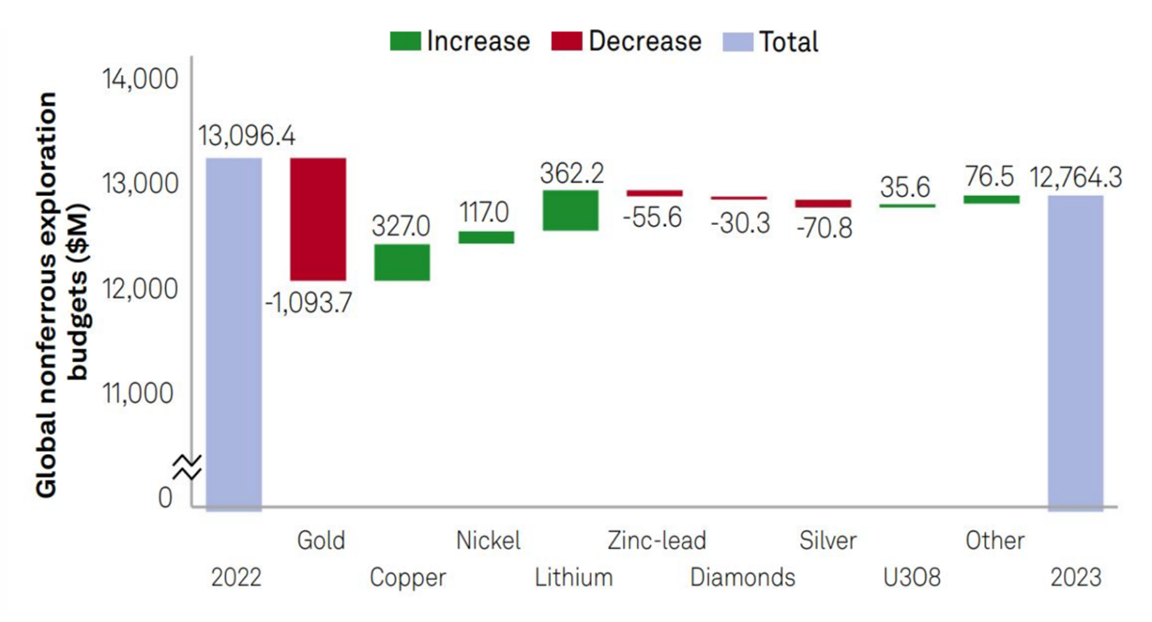

The growing awareness of copper’s supply challenges drives increased M&A activities in the sector. Copper’s exploration budget exceeded $3 billion for the first time since 2013 due to increases from the major producers in Latin America, dominated by major explorers, from whom more than 50% of the budget comes.

Source: S&P Global Market Intelligence

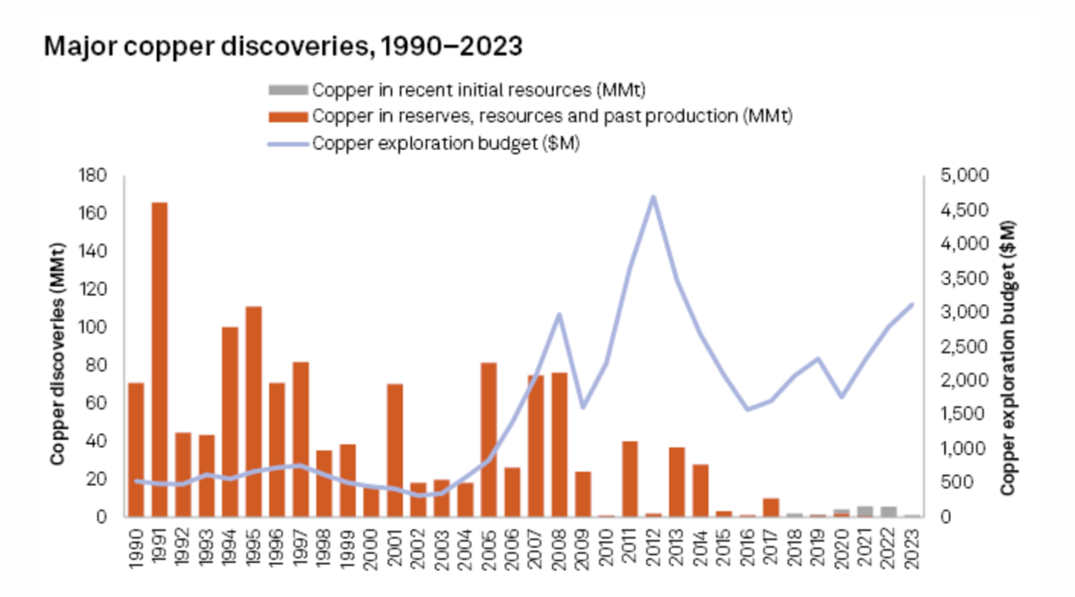

Despite exploration budgets being high, most of the allocations for copper are spent on brownfield rather than on greenfield projects that could start to address the scarcity of the commodity. Developing new projects near existing mines is typically less risky and more cost-effective. The established infrastructure, geological knowledge, and easier permitting make it a more attractive option, especially when the pandemic made large-scale, early-stage programs more difficult in 2020. In 2022, minesite programs became the largest portion of global copper exploration budgets. In 2023, copper explorers allocated the largest portion of their budgets to late-stage exploration at a 37% share — the most in five years — representing a 28% increase from 2022. Despite exploration budgets climbing 12% in 2023, there are only four copper discoveries in the past five years (2019–2023), totalled 4.2 MMt of copper, which underscores the downward trend in the rate and size of major discoveries over the past decade. M&A has therefore come to the fore as a means for companies to grow and consolidate their copper portfolio and strategically position themselves to benefit from the forecast increase in demand and prices.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Strategic M&A Highlights Key Industry Trends

BHP and Lundin’s Joint Venture

A key transaction most recently involves BHP Group and Lundin Mining, who announced on July 29th their joint acquisition of Filo Corp for C$4.5 billion (approximately $3.25 billion). BHP and Lundin offered C$33 per Filo share, a 12.2% premium over the last closing price, with BHP contributing $2.1 billion in cash. This follows Lundin’s 2023 majority stake acquisition in Chile’s Caserones mine and BHP’s bid for Oz Minerals.

The world’s biggest miners are increasingly preferring to buy instead of building assets to grow, given rising costs for developing new mines and a blow-out in timelines for regulatory approvals, emphasizing the industry’s focus on high-quality assets.

M&A Deals in Recent Years: Signals for Global ‘Race’ for Resources

In the past decade, the copper industry has witnessed several high-profile M&A transactions that have reshaped the market. Notable deals include BHP’s acquisition of OZ Minerals, which expanded BHP’s copper portfolio and enhanced its presence in key markets. Similarly, China Molybdenum’s purchase of a controlling stake in the Tenke Fungurume mine in the Democratic Republic of Congo underscored China’s strategic push to secure long-term copper resources.

The copper industry also has witnessed significant M&A activity in recent years as major players strive to secure long-term resource supply and enhance their operational capabilities. Copper M&A activity rebounded significantly in 2022, reaching a 10-year high in deal value and matching the amount of metal in reserves and resources that changed hands in 2018 — the fourth-highest since our study began in 2011. In 2023, there were 14 M&A deals on copper for a total deal value of $4.69 billion. In total, 44.1 million metric tons of copper in reserves and resources exchanged hands. Please refer to Tables 1,2,3&4 for more copper M&A details.

These large acquisitions in recent years are a clear indication of the ongoing race among global miners to secure copper resources. As the world’s biggest miners increasingly prefer buying existing assets over developing new ones, companies with strong copper assets are key to watch.

Investment Opportunities: Juniors to Watch

The copper industry is characterized by two main types of players: major companies and smaller exploration firms. Major players, such as BHP, Rio Tinto, Glencore, and Freeport-McMoRan, have been actively consolidating strong copper assets in response to the rising demand for copper and the escalating costs of developing new mines. These established companies are increasingly focused on acquiring high-quality assets to secure their future supply.

On the other hand, smaller companies, often referred to as juniors, hold early-stage exploration projects with significant potential. These juniors are attractive acquisition targets for larger miners seeking to replenish their reserves. However, to maximize their appeal and secure premium valuations, these companies must operate in politically stable regions where their assets are more likely to be favourably regarded.

In addition to geographical and political considerations, the shareholding structure of these juniors plays a crucial role in their attractiveness as M&A targets. A shareholding structure that allows for relatively straightforward acquisition is essential. Juniors with controlling shareholders, such as government entities, family holdings, private companies, or public corporations, are less likely to be acquired. In contrast, those with large shareholdings held by private equity or other investment groups are more likely to attract acquisition interest.

As the demand for copper continues to surge, future M&A activities are expected to intensify, highlighting the scarcity and importance of high-quality copper assets. This presents promising investment opportunities for juniors, particularly those who can position themselves as attractive targets in the evolving landscape of the copper industry.

For larger players, possessing high-quality copper deposits and geographic advantages alone is not sufficient to make an investment compelling. These companies, often the acquirers in M&A deals, also require financial stability to sustain operations from mining through production and to weather the long-term volatility of copper prices. Therefore, strong balance sheets and robust cash flow generation are critical factors in determining the attractiveness of an investment. Additionally, the capacity for production expansion and scalability—meaning the ability to acquire and integrate additional copper assets to maintain growth—further enhances a company’s investment potential.

The copper industry is undergoing significant changes, driven by strong demand from the renewable energy and EV sectors. As the demand for copper continues to grow, driven by the transition to green energy and electrification, M&A activities in the copper sector are expected to intensify. This evolving landscape presents valuable opportunities for investors, particularly in the juniors who possess high-quality assets in politically stable regions. These juniors are well-positioned to capitalize on the increasing demand for copper and the heightened M&A activity, making them attractive targets for investment.

Buyer | Seller | Target | Deal Value ($M) | Deal Type | Stage | Primary R&R Acquired (t) |

MMG Ltd. | Investor group | Cuprous Capital Ltd. | 1,875 | Company | Production | 10,963,203 |

Lundin Mining Corp. | ENEOS Holdings Inc. | Caserones Copper Mine | 950 | Project | Production | 1,768,170 |

Evolution Mining Ltd. | CMOC Group Ltd. | Northparkes Copper-Gold Mine | 475 | Project | Production | 2,312,000 |

Glencore PLC | Pan American Silver Corp. | MARA Project | 475 | Project | Feasibility | 4,608,948 |

Hudbay Minerals Inc. | Copper Mountain Mining Corp. | Copper Mountain Mining Corp. | 444.7 | Company | Production | 2,409,594 |

First Quantum Minerals Ltd. | Rio Tinto Group | La Granja Project | 105 | Project | Reserves development | 12,130,250 |

Taseko Mines Ltd. | Sojitz Corp. | Gibraltar mine | 86.6 | Project | Production | 357,827 |

Sibanye Stillwater Ltd. | New Century Resources Ltd. | New Century Resources Ltd. | 82.9 | Company | Production | 941,303 |

Glencore PLC | PolyMet Mining Corp. | PolyMet Mining Corp. | 73.7 | Feasibility | Feasibility | 1,315,646 |

Auteco Minerals Ltd. | Rambler Metals and Mining PLC | Green Bay Copper-Gold Project | 44.2 | Project | Production | 720,000 |

Kinterra Copper USA LLC | Highland Copper Co. Inc. | White Pine North Project | 30 | Project | Reserves development | 1,700,426 |

Rio Tinto Group | Arizona Sonoran Copper Co. Inc. | Cactus Project | 21 | Project | Reserves development | 1,339,330 |

Arizona Sonoran Copper Co. Inc. | Undisclosed seller | MainSpring Property | 14 | Project | Reserves development | 3,254,000 |

Hudbay Minerals Inc. | Rockcliff Metals Corp. | Rockcliff Metals Corp. | 13.7 | Company | Reserves development | 280,612 |

Table 1: Copper M&A Deals in 2023 By Order of Deal Size

Metric | Value |

Total deals | 14 |

Total deal value | $4,690.7M |

Primary R&R acquired | 44,061,309 t |

Table 2: Copper M&A Deals Summary in 2023

t = metric ton; R&R = reserves and resources.

Source: S&P Global Market Intelligence

Target | Buyer | Seller | Ownership Acquired (%) | Deal Value ($M) | Primary R&R Acquired (t) |

OZ Minerals Ltd. | BHP Group Ltd. | OZ Minerals Ltd. | 100 | 5,947.70 | 15,202,840 |

Turquoise Hill Resources Ltd. | Rio Tinto Group | Turquoise Hill Resources Ltd. | 49.21 | 3,251.30 | 19,153,638 |

CSA Project | Metals Acquisition Corp. | Glencore PLC | 100 | 1,200.00 | 874,000 |

CRCC-Tongguan Investment Co. Ltd. | Tongling Nonferrous Metals Group Co. Ltd. | CRCC-Tongguan Investment Co. Ltd. | 70 | 955.80 | 4,802,840 |

Reko Diq project | Barrick Gold Corp. | Antofagasta PLC | 37.5 | 945.00 | 9,131,625 |

San Nicolás project | Agnico Eagle Mines Ltd. | Teck Resources Ltd. | 50 | 580.00 | 1,245,000 |

Koksay project | Kazakhmys Holding Group BV | KAZ Minerals Ltd. | 100 | 362.00 | 3,820,000 |

Kalkaroo project | OZ Minerals Ltd. | Havilah Resources Ltd. | 100 | 280.30 | 1,570,600 |

MARA project | Glencore PLC | Newmont Corp. | 18.75 | 174.90 | 2,470,574 |

Round Oak Minerals Pty Ltd. | Aeris Resources Ltd. | Washington H. Soul Pattinson s Co. Ltd. | 100 | 166.50 | 735,080 |

Cornerstone Capital Resources Inc. | SolGold PLC | Cornerstone Capital Resources Inc. | 94.43 | 102.40 | 2,264,904 |

Alacran project | JCHX Mining Management Co. Ltd. | Cordoba Minerals Corp. | 50 | 100.00 | 473,529 |

Table 3: Copper M&A Deals in 2022 By Order of Deal Size

Metric | Value | YoY Change |

Copper deals | 17 | +42% YoY |

Total deal value | $14,228.9M | +104% YoY |

Primary R&R acquired | 53.72 MMt | +172% YoY |

Table 4: Copper M&A Deals Summary in 2022

t = metric ton; R&R = reserves and resources.

Source: S&P Global Market Intelligence